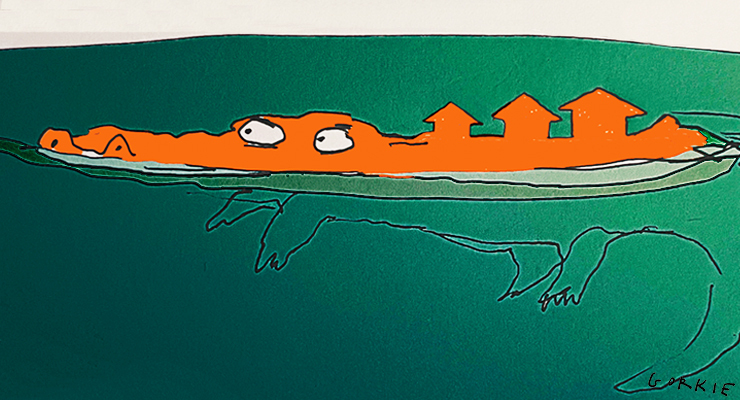

Oh dear. Looks like inflation is back on!

After a downward blip in the October number sowed widespread hope, the November number is back up. Inflation is registering at 7.3% on the Australian Bureau of Statistics (ABS) monthly indicator. That is equal to its record high, as the next chart shows.

What’s rising most? It is still the same damn thing: new dwelling purchases by owner-occupiers. That excludes the price of land and mostly measures the cost of building. It is driven up by the higher price of labour and lumber, etc. The price of building a new home, or getting a renovation, is very high right now: up 17.9% compared to a year earlier.

Automotive fuel bounced enormously in the month too, up 16.6% over the year to November. November was a period of rising petrol prices as the local market reacted to higher prices in global oil markets, and as the end of the fuel excise cut continued to take effect (it officially ended on September 30 but the price rises happened over time).

As the next chart shows, petrol prices were very high in early November before falling in the second half of the month.

There’s good news on petrol though. Back in November, global oil markets were driven up by fears there wouldn’t be enough fuel for the northern hemisphere winter. But it’s been balmy in Europe and oil prices have fallen. The November peak price of a barrel of crude was higher than today’s price. So not all of the inflationary pressures of November will be sustained. This is good news: we can expect inflation pressures from this category to ebb.

Fruit and vegetables are another category high in November that has reduced since. My own grocery receipts show a head of broccoli was $2.15 in November last year, and Woolworths is advertising one for $1.62 today. Zucchini too: down from $1.58 to $1.18. Prices were driven up by floods in November but shortages are being overcome.

This is why the Reserve Bank (RBA) likes to remove several of the most volatile series when it strategises on how to react to inflation numbers.

Still, the high result means the RBA is likely to pull the trigger on another rate rise in February. The market is pricing in approximately a 50% chance and commentators are locking it in, especially since the job vacancies data shows a continuing high rate of around 0.95 vacant jobs per unemployed person.

“[This data is] strong enough to reduce any risk of a pause in February for the RBA and reinforce our view that the peak cash rate will be at least 3.85%,” ANZ economists wrote in a note to clients yesterday.

What’s interesting though is that while markets expect rates to rise immediately, the expectations of later rate cuts have also firmed. Interest rate futures markets were pricing in a slower rise and slower fall before this latest data. Now they expect a sharp rise in rates, a peak in September, and the first chance of a rate cut in December this year.

Of course, the full effect of all of 2022’s rate hikes is yet to be felt. They will continue to seep into the economy even as the RBA piles on additional cuts. Getting the balance right will be very hard. Can they compress prices without crushing the economy? We will know much more by the end of 2023.

Interesting. The NYT reports that US inflation is falling so I suspect if that trend continues the same will happen here as price gouging and supply chain constraints ease. Media hysteria is a lagging indicator.

Increasing or high CPI or inflation is a great way for masking increased revenue or profit margins?

Car insurance gone up 20% since last year.

Health insurance continues increasing every year.

No wage rises coming to offset it either. The vast majority of workers have next to no bargaining power.