Qantas is now predicting a first half profit before tax of between $50-150 million, and today reported a strong rise in passenger numbers for the group airlines of 9.7% in its provisional November operating statistics when compared to a year ago.

Most of that growth came from its domestic and international Jetstar services, as shown in the table below lodged with the ASX today.

While the November figures still put domestic yields in the month as down by -8.9% compared to 2008, and international yields off by -23.2% Qantas clearly sees signs of improvement after the New Year, which is also when the dilution of yields by massive discount sales of forward inventory earlier this year should be coming to an end.

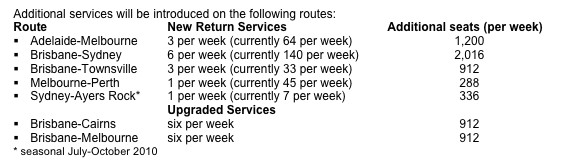

This view is also confirmed by a separate Qantas announcement today that it is restoring some of the domestic capacity cutbacks of the past year from the end of March.

Qantas sees growth returning and isn’t thinking about turning any of it away because of lack of seats.

These are the domestic changes:

It has also boosted its Cityflyer 737 services between Adelaide and Brisbane by four per week from December 29, which is a 20% jump in capacity and more evidence the market is coming back strongly.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.