Internationally, at least, the economic issue that has dominated 2023 seems to be resolving, and quicker than expected.

At the start of the year, US consumer prices were rising at an annual rate of 6.5% in January and 6.4% in February. In November, growth was back to 3.1%. In the Eurozone, inflation of 9.2% in January was down to 2.4% in November. The UK saw January’s 10.5% rate slide to 3.6% in November — and down from 4.5% a month earlier, too.

The faster-than-expected fall has been accomplished with little or no visible cost — yet — in terms of higher unemployment or falling wages. Real wage growth has been happening in the US now for several months, is making appearances in parts of Europe, and began to appear in Japan earlier in the year. It may soon return in Australia, if Reserve Bank and Treasury forecasts are correct.

There may be cyclical factors for why unemployment has barely shifted despite a global significant tightening in interest rates, but we’d suggest it’s the first sign of a theme that will dominate economics for the rest of the century: a lack of workers, at least in occupations where AI and robotics haven’t yet provided workable replacement options (and good luck with that in the fastest-growing area of the economy, health and caring services, which still require real humans).

But China is ending 2023 with deflation at the consumer level dominating (thanks to slumping pork prices) and at the producer level as well, despite solid demand for major commodities such as copper, thermal coal and iron ore. China also faces a property crunch next year, with half a dozen big developers failed, failing or verging on failing, and hundreds of billions of dollars in debt to be accounted for one way or another among companies and local governments.

If China had inflation, the clever option would be to do nothing and allow inflation to gradually reduce the value of the debt, while lifting property prices and improving the financial/asset positions of stricken companies and local governments. But deflation will make for years of hard labour for President Xi Jinping. And every year that passes in China slowly increases the demand problem created by an ageing population. As a Chinese think-tanker told Crikey earlier this year, what worries them in China isn’t the shrinking workforce produced by an ageing population, but the shrinking demand it will cause.

The fall in inflation hasn’t been as great here, but the Australian Bureau of Statistics’ monthly inflation indicator has fallen from 7.5% in January to 4.9% in October — despite all the hysteria from business, the Financial Review and even the Reserve Bank about productivity, nominal versus real wage costs and wage/prices spirals. Perhaps the high levels of concentration in the economy, and the lack of interest in how much corporate greed has driven inflation on the part of policymakers, have prevented inflation from falling as rapidly here as elsewhere?

What the great focus on inflation in 2023 has also done has been to shine a light on just how ordinary the quality of economic debate in Australia is — including in some of our most important institutions.

It’s widely accepted now that both governments and central banks overreacted to the pandemic with far too much stimulus. No blame attaches to that — it was entirely understandable given that we hadn’t had a global pandemic for a century, its impacts were uncertain and everyone was terrified about what was happening. Even former RBA governor Philip Lowe’s notorious “no rate rises until 2024” was said in the context of a central bank that feared the four horsemen of the apocalypse had just ridden into town. We can all be critics now (and we are), but it’s about learning the lessons about what worked and what didn’t and how we assess what to do in the event of another crisis like that — because, almost certainly, there will be one.

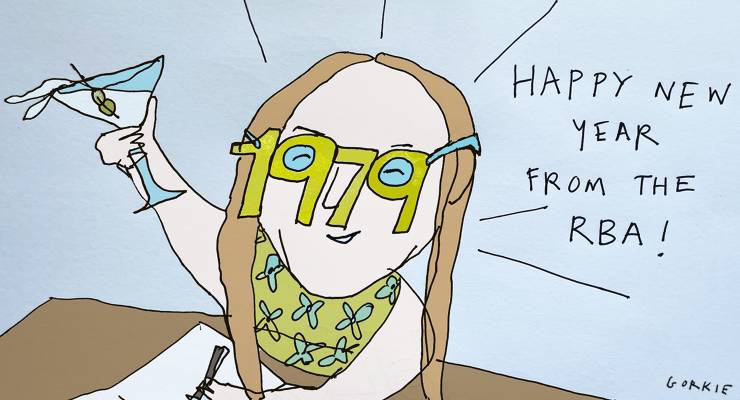

But the responses of the Reserve Bank, and of many economic commentators and lobbyists, to the inflation surge that followed the pandemic and Russia’s attack on Ukraine were very different. It was characterised by wilful, reckless ignorance, an ideological bias against workers, and an inability to think beyond the textbooks of the 1970s and 1980s.

It was as long ago as September 2022 when Crikey discussed why central bankers needed to adjust their thinking to a world that had grown more volatile and more inflationary as a result of global heating, pandemics, decoupling and a growing shortage of workers.

The Reserve Bank’s leadership, which is paid a lot more than us to think about such things, didn’t catch up for a couple of months — and at no stage since, either under Lowe or Michele Bullock, have its actions reflected any adjustment in thinking about the new, more inflationary world. The RBA still thinks it should respond like we’re in the economy of the 1980s and 1990s, when there were no problems that weren’t demand problems, unemployment and inflation came with zeroes on them, pandemics were confined to movies, and climate change was a warning from scientists, not a grim reality.

So do many inflation hawks with brains stuck in the Reagan-Thatcher era who, courtesy of their business wealth or academic tenure, have no comprehension of what it’s like to struggle to make ends meet, even on two incomes. They can be found in the pages of the AFR every week, demanding more and bigger rate hikes to punish ordinary households, or attacking wages growth, even as the evidence mounts that greedy businesses are a key cause of inflation.

The denialism of that fact, from the Reserve Bank especially, is something that should never be forgotten. There are no excuses — especially given other central banks, and major global institutions such as the OECD and the IMF, were taking the issue very seriously. If the consequences weren’t so damaging, the RBA’s determined effort to bury its head in the sand of neoliberal orthodoxy would be hilarious.

As a result, the RBA continued to jack rates up in pursuit of inflation it began insisting was demand-driven and home-grown, when the only thing home-grown about it was the Australian companies making out like bandits under the cover of needing to pay for higher costs.

The result is an economy barely ticking over, depending on government spending for life support, and which may yet tip into recession next year. The RBA sees growth of 1.8% in June next year and 2.0% by the end of that year. Other private forecasts range from 1.5% to 2.2%. But much depends on commodity prices: the Department of Industry’s most recent energy and resource quarterly is forecasting a slump in our terms of trade in 2023-24 and 2024-25 that will see export revenues fall by $118 billion. A few missiles and drones in the Red Sea might change that dynamic in terms of energy prices, so we’ll see.

While we wait, perhaps Bullock and the RBA can use the summer break to get up to speed on economies in the 21st century. An awful lot of workers are depending on it.

I doubt the RBA Governor will bother to read up on new economics. She has been with the RBA most of her working life and is brainwashed into thinking too narrowly. When one is stuck in a rut and knows nothing else, one’s brain begins to atrophy. RBA Governors should be appointed from outside. Bring some fresh perspective to the role.

All Neo-liberal numpties stuck in the past!! An ongoing scandal – the RBA!

While corporate profit taking continues unabated. Obviously investors are more interested in ROI then in the people that generate that ROI. It’s just greed. And the RBA doesn’t have the remit to manage investor and corporate greed. That’s the job of a regulator, aka the government. Even at tradie level, a tradie contractor can make enormous profits and not share that wealth with his award wages workers. We have the wrong value system. Failure is inevitable.

China will have no problem negotiating economic winds, they’re big enough to do what they want. They are without corporates siphoning from those that can’t afford it with their media propaganda machines telling us its ethical. China has its state media propaganda supporting the government leadership. However the environmental damage created by producing the worlds cheap stuff will take some serious cleaning up then again we have 2000 badly polluted sites at least. China can fudge the books and devalue the rest of the world just as the US has done.

The US simply printed money and every country that could followed suit after the GFC to keep up.. It could have just as easily created a UBS and restored their economy. Greece on the other hand just doesn’t have the industry , mining or size to weather such difficulties.

If we keep our population low we can manage any storm. It is currently too high and an ageing population is good for us. Our media misrepresentation of just about everything makes it unlikely we won’t suffer as a country. We’re at the mercy of those that own the media because they control the main sources of information for corporate vested interests. Media ownership and proper checks and balances are crucial to a healthy democracy, inevitably all other checks and balances fall in behind it. Happy to be correct..ed.

… is, of course, a myth. He did not make any such firm commitment. He said there would probably be no rate rises until 2024. I’m no big fan of Lowe, but he has been horribly traduced and falsely denigrated for a statement that was, so far as anyone can tell, correct. At least, I do not recall anyone saying his assessment of the probability was wrong at the time he made it. The pile-on only began when interest rates started rising, so those attacking Lowe all had the benefit of 20-20 hindsight to help them. None of them seem to have been so wise before the event.

If I’m going to roll a six-sided dice and I say that I’ll probably not roll a six, my statement is right whether or not a six comes up. If anyone else bets against a six being thrown and then loses their bet, well, don’t blame me.

Rubbish! It was just so stupid to say, and keep saying that rates would ‘probably’ not rise until 2024!! As Governor of the RBA, he and his advisors should have know this would be misinterpreted and or taken as gospel!! It was just dumb. As for others at the time, I think A Kohler and a few other economists/journos were dubious. Lowe, of all people should have been careful with his comments- he deserves all the criticism and more!! What an overpaid dope as it turns out and no real consequences for his failures!!!

So you blame him, not for what he said, but for what was misheard by the careless or misrepresented by the malicious. It is a pity folk do not take responsibility for their own actions and instead must find a scapegoat.

Yes, I blame him and the entire RBA board at the time. Language is important and given his/their role, should have foreseen the reaction to those repeated comments about low interest rates and 2024. Why say it at all? Yes, people must be responsible for their own decisions but the feeling coming out of Covid and rising house prices in 2021 was one of ‘missing out’. So not surprisingly, many people felt reassured by Lowe’s dodgy/probably comment. Don’t try to change history. You are trying to defend the indefensible!

The main things required to fix the economy are due from the govt.

The government risks losing its majority because it is too timid. While keeping promises, it really needs to start to move and plan to address these things. Maybe not in one fell swoop as Bill Shorten was trying to do. But at least to move on some of these things, even in increments. Th argument that things had changed might have come and gone as the economy is doing well for the non-mortgaged and better off in society, so they risk just saying all is going well.

Yes BK, but given the RB functions strictly within a parameters set for it with little discretion to adjust for varying conditions, what else can it do? Blaming the Creature lets Frankenstein off the hook.

Really ? Because creating demand seems like a fairly easy problem to solve (inject money at the bottom of the socio-economic pile and tax it back out at the top).

Seems even an allegedly communist nation is in thrall to neoliberal greedblind idiocy.

Can’t turn down the firehose of largesse to the haves for a moment, otherwise we might be able to bear the foundations of civilisation crumbling.

Hear, dammit. Loving this “website upgrade” where we got all these wonderful new features like edit and formatting buttons that have existed elsewhere forever