The Qantas financial report for the 6 months to December 31 contains some sobering figures as well as some reasons for optimism, but basically, Jetstar is booming, mainline isn’t and shareholders get nothing by way of dividends.

Note that sales and other income (in which sales of ‘loyalty’ points to third parties are a major component) fell by more than $1 billion compared to the corresponding first half of 08-09 or down by -14%.

Note that sales and other income (in which sales of ‘loyalty’ points to third parties are a major component) fell by more than $1 billion compared to the corresponding first half of 08-09 or down by -14%.

The accounts show that earnings per share in the six months to December 31 were 2.6 cents, compared to 10.7 cents in the previous corresponding half, for which the last Qantas dividend of 6 cents per share was paid.

The accounts show that earnings per share in the six months to December 31 were 2.6 cents, compared to 10.7 cents in the previous corresponding half, for which the last Qantas dividend of 6 cents per share was paid.

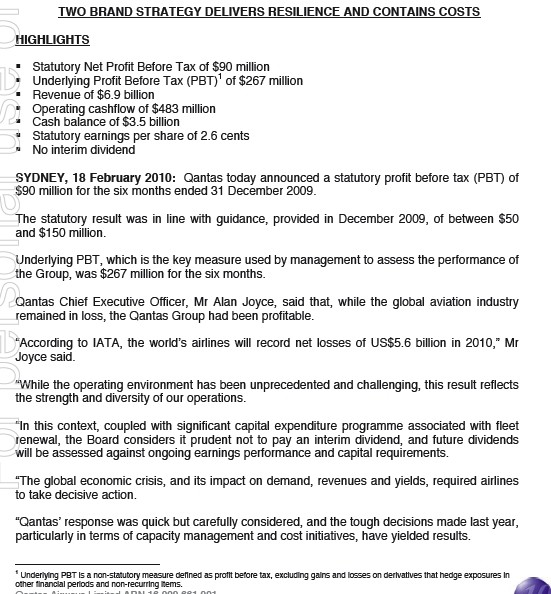

This is the summary page from the spun press release, which is quick to invoke the IATA overview of its own basket of under performing carriers which is of only partial relevance to Qantas.

The press release also introduced heavy reliance on so called ‘underlying’ profit calculations, and caused confusion during the press briefing in the Alexandria warehouse now known to some company wits as the John Borghetti memorial Centre for Service Excellence, which is so inconvenient for parking and public transport that most media dialled in by conference call.

Qantas CEO Alan Joyce said that every segment of the group, meaning Qantas, Jetstar, Frequent Flyers for shoppers (and real flyers) and freight all made money in the half, but didn’t dispute one reporter’s description of the Qantas full service performance as ‘woeful’ other than to claim solidarity in that respect with other full service carriers.

This is the comparison of all the Qantas brands versus all the Jetstar brands (Asia excluded) offered in the newly dominant underlying profit before tax metric.

Joyce said yields were recovering some of the 20-30% decline suffered on premium or full service products and that international was lagging behind the rate of improvement seen in domestic and regional divisions of Qantas.

He announced that Qantas would no longer offer profit guidance in other than terms of underlying trends which would remove the distortions caused by hedging provisions and other derivative effects which may not in fact come into play in a particular reporting period.

As a consequence of this the company was estimating that the full year to June 30 underlying profit before tax would be in the range of $300-400 million compared to the declared underlying PBT to December 31 of $267 million.

So, if the statutory or ‘old fashioned’ net PBT was $90 million on an underlying net PBT of $267 million in the December half of this financial year what will be the standard old fashioned full year net PBT be on a forecast underlying net PBT of $300-400 million, a figure which of itself suggests the ‘recovery’ isn’t as exciting as expected?

Qantas this morning wasn’t saying what it would be. This might change.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.