Some years ago, I published a paper with Tony Atkinson looking at trends in Australian top incomes since 1921. We’ve now updated the results to the 2007-08 tax year (the latest available from the ATO).

The study combines taxation data with external information (such as population totals, and the total personal income if everyone was required to file a tax return), in order to calculate the share of income held by particular top income groups.

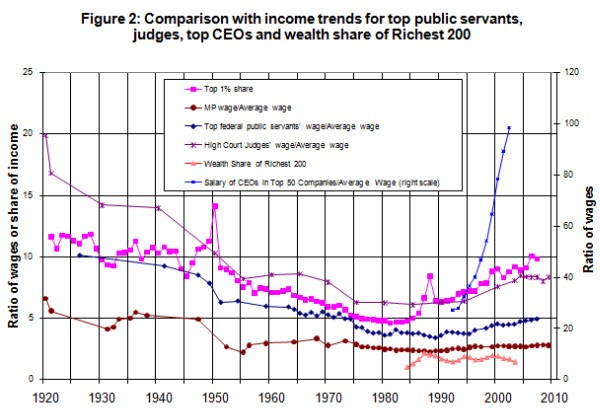

From 1993 to 2009, the pay of top-100 CEOs rose twice as fast as the salary of ordinary workers. In that period, the average earnings of CEOs rose by an average of 7.5 per cent per year. Over the same period, average salaries across the economy rose by an average of 3.7 per cent per year.

In 1993, the average earnings of CEOs in the top 100 Australian firms was about $1 million. By 2009 this had risen to around $3 million.

The salaries of High Court Judges and the country’s top public servants have also risen faster than average earnings. The income share of the richest one per cent (those earning more than $197,000 in 2007) declined from 1921 to 1980, and has risen since then. In 1980 the top one per cent had five times their share of household income. Now, the same group has 10 times their share of household income.

This pattern is even starker among the top 0.1 per cent (those earning more than $693,000 in 2007) whose share of household income has more than tripled since 1980.

Top 10 per cent:

- In 2007, the cut off for entry into the top 10 per cent was individual income of $73,000.

- In 1941, the top 10 per cent had 34 per cent of all household income. This dropped steadily until 1980, when that group had 25 per cent of household income. Over the past generation, it has risen again, and the top 10 per cent now has 32 percent of household income.

Top 1 per cent:

- In 2007, the cut off for entry into the top 1 per cent was individual income of $197,000.

- In 1921, the top 1 per cent had 12 per cent of all household income. Again, this dropped steadily until 1980, when that group had 5 per cent of household income. In 2008, the top 1 per cent had 10 per cent of household income.

- Salary earnings comprised 6/10ths of top 1 per cent incomes in the late-1990s, but only 4/10ths by the late-2000s.

Top 0.1 per cent:

- In 2008, the cut off for entry into the top 10 per cent was individual income of $693,000.

- In 1921, the top 0.1 per cent had 4 per cent of all household income. By 1980, that group had just 1 per cent of household income. In 2007, the top 0.1 per cent again had 4 per cent of household income.

CEO Pay:

- Over the period 1993-2009, the average earnings of CEOs in the top 100 Australian firms rose by an average of 7.5 per cent per year (Productivity Commission, Executive Remuneration in Australia, p.61). Over the same period, average salaries across the economy rose by an average of 3.7 per cent per year.

- In 1993, the average earnings of CEOs in the top 100 Australian firms was about $1 million. By 2009, this had risen to around $3 million.

Other top groups:

- The salaries of High Court Judges and top public servants have followed a similar trajectory:

Tomorrow: Possum Comitatus and Bernard Keane crunch the numbers.

This is from the same mob who always claim increasing wages will lead to an inflationary outbreak. Greedy punks.

What I find really offensive is that they just aren’t worth the money

I think “The Pav” is absolutley correct — they are just not worth the money, but they have convinced their boards (mostly part of the same grossly overpaid mob) to pay them these ridiculous salaries and (unearned) bonuses because they think they cannot be replaced for less. I thought Kevin Rudd was going to address this issue (in light of the fact that the government had to support the banks, and thus their overpaid CEO’s), but it was all too difficult.

The governments of the USA and UK had to go much further than here, but again don’t seem to have made the greedy wake up to their greed. The shock would have been huge, but perhaps Fanny Mae and Freddy Mac and Goldman Sachs and AIG should all have been allowed to drown.