A fun sidelight. Come Tuesday and the economic teams of one of our major trading banks is going to be red faced. In a wonderful battle of the pundits we have Westpac’s Bill Evans on one side predicting that interest rates are about to fall. On the other is Katie Dean of the ANZ who is now in the rates will rise camp.

Two weeks ago, Katie Dean of the ANZ was worried about the impact of overseas developments as she told Bloomberg television that she would not rule out a fall in interest rates and expected the Reserve Bank to hold them steady for quite a long time.

But a week’s a long time in the economic prediction business. After the release of the latest consumer price index figures Ms Dean was making a mockery of her own words by expressing confidence that the RBA at Tuesday’s meeting will lift the cash rate to 5.0 per cent from 4.75 per cent. In an analysis with fellow ANZ Warren Hogan she declared Wednesday’s June quarter inflation numbers were “uncomfortably high”.

“A small upward adjustment to interest rates now could well save the Australian economy from a painful series of rate hikes in 2012,” they said.

The Westpac team is sticking to its guns.

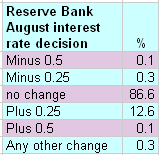

And what of the Crikey Interest Rate Indicator? It continues to have no change as far and way the most likely outcome but a rise is now back in front of a fall as the next probability.

The January predictions. Back in early February the business sections of the Murdoch tabloids asked what they described as “four respected rate watchers” to make their interest rate predictions for the year ahead. How have they fared?

JP Morgan chief economist Stephen Walters believed the Reserve Bank of Australia would lift rates by 25 basis points at its February board meeting, the first for 2011. No joy for him. Rates have yet to change.

Annette Beacher, head of Asia-Pacific research at TD Securities, is also behind the eight ball. She too predicted a rate rise in the first quarter and went further by expecting it would be one of four 25 basis-point rises throughout the year.

Former RBA staffer and now HSBC chief economist Paul Bloxham believed the RBA will hold off until the second quarter of this year before raising rates. Bloxham, “who impressed observers last year when he went against the tide of market opinion and accurately predicted the RBA would leave rates unchanged in October”, expects three, 25-basis-point rises in the year. The bank will need to get a hurry on for him to be in the money.

The UBS interest rate strategist Mathew Johnson expected the RBA would hold off for the first half and not raise rates until the third quarter. So far so good for him.

No rush for Julia. London’s Daily Telegraph has drawn attention to the way that the popularity of a name for new borns drops once some one with it becomes Prime Minister.

“Call it the curse of power: as soon as a politician gets into Downing Street, his name becomes mud. The Office for National Statistics has revealed that, in the year the Coalition was formed, the popularity of the names ‘Nick’ and ‘Cameron’ took a nosedive. ‘Gordon’, meanwhile, appears to be suffering the fate of ‘Adolf’ in 1950s Germany, chosen by just 10 brave souls in England and Wales — only seven more than bestowed the name ‘Timotei’ upon their fragrant daughters.”

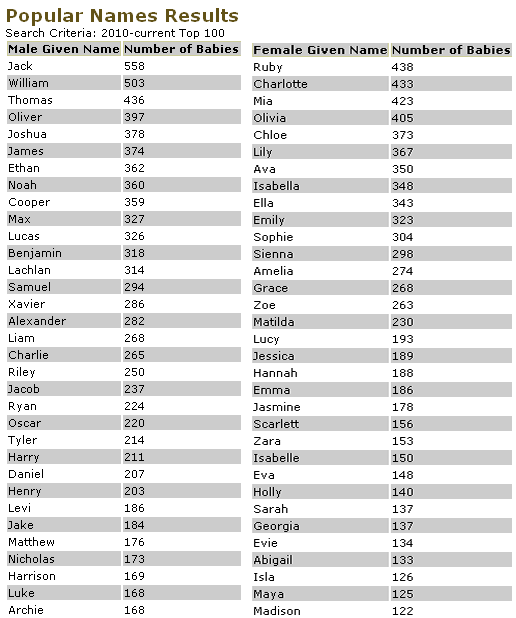

So too, it seems, in Australia where Julia has now dropped out of the top 100 list of most popular names kept by the Victorian Registry of Births, Deaths and Marriages. On the men’s side there is neither Kevin nor Tony makes an appearance.

The current favourites:

There