The conventional wisdom about the Australian economy at the moment is that it is a two speed, or multi-speed economy, with the faster bit resources and slower sectors such as retailing, manufacturing and housing construction.

Equally conventional is the way consumer confidence and retail data is being analysed, without any of the commentary taking account of all purchasing and savings decisions by consumers. It’s a case of consumer confidence low, consumers cautious and saving.

But it’s not so black and white. While “two speed” is a convenient and ignorant way of analysing the current state of the economy (when has the Australian economy ever operated at the one speed?), it’s one that the same economists and media commentators strangely ignore when looking at the standout sector in all the chats, retailing. Just as the Australian economy has never grown uniformly, so retailing has never had consistent expansion across all sectors.

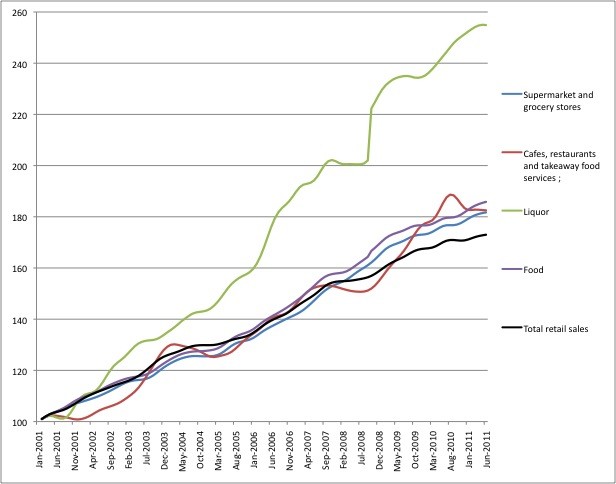

To illustrate the point, we took the ABS’s trend retail sales data across a range of categories and looked at growth in turnover since 2001, using January of that year as the base number – how has each sector performed since then? The best performing sectors are food and drink. They’ve performed better than total retail sales – that’s the black line.

Ignore the huge surge in October 2008. We didn’t rush out and drown our sorrows over the GFC, the ABS flagged there’s a possible break in the data series. Nonetheless, even accounting for that, we love our grog and turnover has grown faster than any other category. Supermarkets and food – the two categories obviously overlap considerably – show more or less steady growth, as you’d expect – food prices, consumption and population don’t lurch around in a developed country.

Cafes, restaurants and takeaways, which are more heavily dependent on discretionary expenditure, are more volatile than food and took a hit during the GFC and have also leveled off since around the election last year, but it’s still well above that total sales.

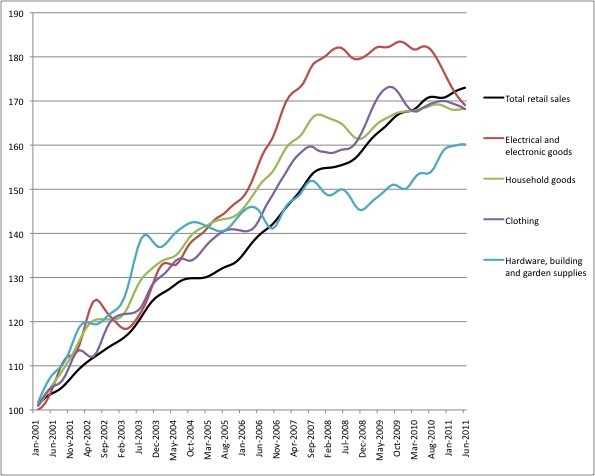

Now let’s look at some other sectors, but keeping that black total retail sales as a guide.

These groups grew as well as, or better, than total sales until 2007 or thereabouts, but then diverged, for different reasons. Hardware, building and garden supplies — remember this is retail turnover, we’re not talking about the construction industry — fell in a heap from the middle of 2007 and has only really been growing strongly again in the last twelve months. Household goods used to grow much more strongly than total sales but again in 2007 turnover collapsed, only there hasn’t really been much of a recovery. Clothing – now a prime category for foreign internet competition — shows a similar experience, except for a bump early-mid 2009 – stimulus payments? – and it has been flat ever since.

And most spectacular of all has been electrical and electronic goods, which soared high above total sales, up with food and liquor, until flatlining in early 2008. There was a mild recovery around the time of the stimulus payments, which some of us called “plasma and pokies payments” but since then the collapse has been dramatic. The collapse has been all the worse because the Australian dollar has in that period made most electrical goods significantly cheaper. Of course, the problem is the high dollar has also made foreign retailers’ electronic products more attractive as well. When you factor online retailing in, a high dollar is a now a problem for some retailers, no longer an opportunity.

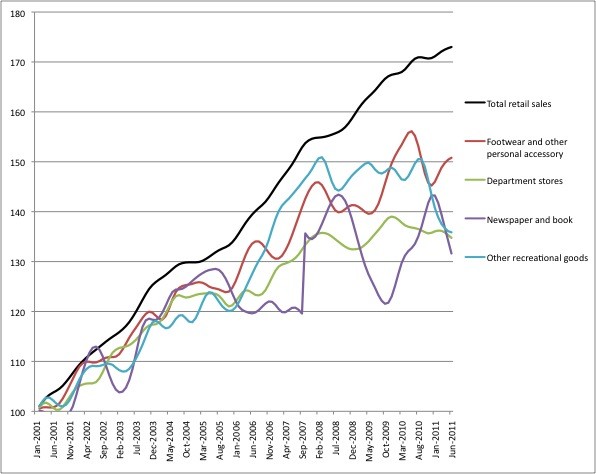

Now there’s a third category of products, which have markedly underperformed total sales.

These categories are much more volatile but all show bad news. Since 2007 footwear – another product that notionally benefits from the higher dollar but is under real threat from online retailing — has struggled, a brief surge in 2010 aside. Recreational goods have dramatically collapsed in the last twelve months, with turnover back to levels of the mid-2000s.

Then there’s department stores — a key retailing sector. They were performing similarly to all retail sales until 2004, and then adopted a different trajectory. Department store growth has been flat for more than three years. Department stores have been the second worst-performing sector. And the worst? No prizes for guessing. For newsagents and bookshops, the only joy is a statistical error – the big jump in 2007 is a possible data break, according to the ABS. It’s the poorest-performing sector of all since 2006.

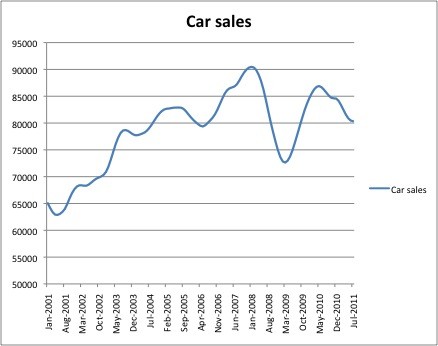

Just one more graph – trend sales in new cars:

This ones a little more tricky to read — this is actual cars sold, not value, which plainly would have increased over time since 2001 — so the basic gradient of this graph is too low compared to the ones above. But it demonstrates what an impact another of the Government’s stimulus measures, the small business tax rebate, had on sales in 2009 (don’t hear the shockjocks and the Coalition whingeing about that stimulus measure, do you?).

That impact has long since dissipated but, despite the ensuing downward trend, car sales are still performing better than many retail sectors.

In fact car sales is a perfect example of what we mean: many economists and media writers consistently ignore car sales when talking about retailing and yet, as the Australian Bureau of Statistics reported, “the July 2011 seasonally adjusted estimate for new motor vehicle sales (84 733) increased by 8.6% when compared with June 2011.” In fact that was the sharpest July increase for 11 years. If had not been for the impact of the Japanese earthquake and tsunami on car imports from late March onwards, Australian car sales would be showing a substantial improvement this year.

And yet the solid growth in car sales is ignored in most analysis. The Americans are far broader with their retail sales measures — they cover cars and petrol sales in particular.

It’s the same with overseas travel. Travel is part of retail sales — there are online and bricks and mortar outlets, listed companies like Flight Centre and Webjet, that are doing very well, and yet economic commentary ignores this and concentrates on what’s sold through the David Jones, Woolworths, JB Hi-Fi and Bunnings of this world. Departures from Australian airports were up 11% in the year to June 30, and are up 25% over the past two years.

So while Australian consumers are saving (the savings rate is running at 11%), they haven’t shut their wallets. Travel and car purchases are major financial decisions and require savings and finance. Worried, gloomy people don’t normally undertake such large financial decisions at the rate they have been for the past couple of years. Car sales in 2010 and this year (with the stimulus impact out of the way), are running at near record levels.

The big factor here is the impact of the higher Australian dollar: while it is hurting some retailers in consumer electronics because foreign purchases are now dramatically cheaper, the benefits don’t all flow overseas: it helps car and travel companies sell more products and services to more Australians (and that includes corporates and governments in cars).

Tomorrow: Five good reasons why retail is far more complicated than the commentators will tell you.

Thanx for this, most informative.

Is the travel component Domestic, International or both? You can thank the AUD for it if it includes International Travel. And with that, if you’re flying on an international airline and taking off to an overseas destination, surely this is money flowing out of the country that would otherwise be spent here?

I assume the vertical access is $’s? If we factor in the impact of the stronger $, the shift to web shopping from os (which I also assume is not included – how could they measure it) a lot of this decline or flatness would be explained.

The significant other factor which this doesnt show up is if there is any change in units. For instance, there has been plummeting unit prices in a lot of the goods because we are buying brands like Ozit, Kona etc which are very cheap (and not just because of the exchange rate). We only need one drill but it costs $35 at Bunnings rather than $150.

Hey Bernard, Great Work. Can’t imagine those whingeing about how teh interwebz are killing them will let facts stand in the way of their whinge, but at least it’s there in front of them now.

I’m afraid David Jones and Myers have priced themselves out of the market. All of their items are so expensive, I can’t imagine anyone buying a dress or a pair of shoes when they can get them at half the price down the road. The same goes for restaurants. Went out for dinner the other night in Perth and the bottle of Australian wine was $95. They are definitely catering to the people that work on the mines….cause nurses, police and ordinary folk sure can’t afford prices like that. Why do you think everyone is going overseas and we have no visitors…..go down to Margaret River and check out the prices! You will be broke after the first day….accomodation – $200, breakfast – $25, lunch – $30, dinner – $60…add on a few glasses of wine $9-12 glass, plus the petrol to get down there etc.