A schooner of beer that costs $60? A loaf of bread for $20. A shirt that costs $350? There have been some wild claims on both sides of the climate change and carbon tax debates, but nothing quite matches the investor update presented last week by the Indian-owned and Wollongong-based coal miner Gujarat NRE.

Gujarat NRE (that stands for natural resources environment) warns that a carbon tax will cause stratospheric price rises for beer, bread, shirts and petrol. In a presentation delivered to analysts and investors at the Hilton Hotel in Sydney last week, and released to the ASX, the company said a carbon tax would render thousands jobless, plunge the economy into “de-growth,” create instability and penalise the entire community.

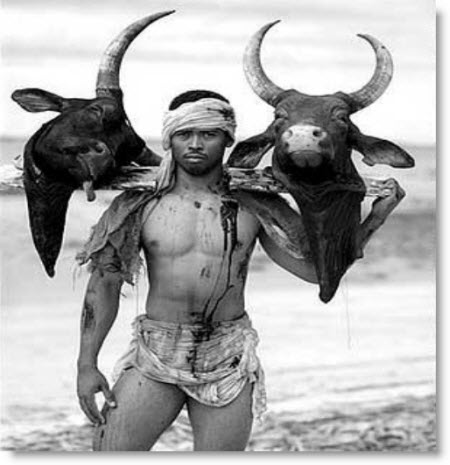

Coal, it says, was responsible for the transformation of the planet caused by the industrial revolution. Without coal, Gujarat says, civilisation would not have developed as it has. To underline the point, and to bring the level of corporate disclosure in ASX announcements to new heights, it provides this potent image of where we’d be without it …

Without coal, it continues, forests would be denuded, unemployment would rise to “humungous” proportions, and worse, “mankind would be stumbling in the quagmire of lost opportunities”. Just like this …

“Mining has helped us to tide over the recent global economic crisis, and may do the same for the impending one … if we do not want to kill the goose that lay (sic) golden eggs.”

Gujarat says there is no alternative. Nuclear power is not safe — “Japan is the living example”, oil and gas are costly and would be more so without coal; and renewable energy cannot meet the burgeoning energy requirements.

Gujarat then goes on to plead a special case for coking coal, “the green variety”, which is used for steel making and that its mines in the Illawarra mostly produce, and thermal coal that’s used in power stations.

“Coking coal needs to be treated differently and coking coal producers seek preferential treatment and not bundled in a single category of coal,” it suggests.

Gujarat NRE is 70% owned by the Indian coal miner Gujarat NRE Coke, which buys most of the coal, and wants to expand both its mines to produce three million tonnes a year over a 30-year period. Last year it made a $24 million profit from its Australian operations.

We just hope that the investors and analysts to whom this was presented have bought the argument. While share prices of coal companies in general have been rising strongly, thanks to the surge in international coal prices, Gujarat’s has been travelling in the opposite direction, falling by more than two thirds since January.

In the more conventional part of the 40-side presentation, the company says the carbon tax will apply to both mining operations, but because they are relatively gassy mines, they will be eligible for assistance under the government’s package. And it notes several opportunities have been identified to reduce and manage fugitive emissions from both mines, thereby reducing the carbon tax liability.

The lesson from all this? Best to go long six-packs. Big time. Particularly if the carbon price legislation is passed. If Gujarat is right, the value of beer will soar. Bread too, but it might not last as well. And if Tony Abbott wins and the carbon price is repealed, then you’ll just have to drink them.

*This article first appeared on Climate Spectator

Excellent sign me up now I love fantasy!

“And it notes several opportunities have been identified to reduce and manage fugitive emissions from both mines……” Manage fugitive emissions? Hah hah – bit like managing fugitive emissions from bottom burps eh?

Now here’s where the real action is. No, not by our duplicitous governments but by FOE who has performed good deeds for the environment for over 40 years. Good deeds that the EPA and environmental departments should have been performing 40 years ago if they hadn’t been kneecapped by dodgy politicians including Prime Ministers, Premiers, Ministers for Foul Mines and Ministers for a Dirtier Environment:

“Graziers, greenies ally against Xstrata, Brisbane Times, Christine FlatleyAugust 22, 2011 – Global giant Xstrata should be refused permission to open a new coal mine in Queensland that will have serious adverse impacts on the climate and nearby graziers, a court has heard.

“Green group Friends of the Earth appeared in the Brisbane Land Court today in an attempt to scuttle an 11,000-hectare coal mine planned for the small town of Wandoan, 400km northwest of Brisbane.The group says it will be the first in Australia to argue for an outright refusal of a mine based on its climate change impacts.

“They are arguing the mine, which will extract 30 million tonnes of coal each year and create 1.3 billion tonnes of carbon dioxide emissions, will lead to catastrophic impacts through the burning of coal.”This mega mine will be one of the largest coal mines in the world, and contribute a sizable 0.15 per cent of annual global emissions every year,” Friends of the Earth spokesman Dr Bradley Smith said……

“Friends of the Earth was joined in court by farmers from the Wandoan region, who are objecting to the mine because of fears it would dramatically affect their lifestyles and livelihoods.The landholders have filed more than 20 grounds of objection against the project……….The case continues.Graziers, greenies ally against Xstrata.”

Strewth – What’s with the grizzly picture and the animal heads? Aren’t we suffering enough already?

It’s a positive feedback loop. More mining pushes up the exchange rate which enfeebles manufacturing further which strengthens the case for more mining. This situation is not unique to Australia. West vs East Russia, East vs West Canada suffer exactly the same anguish.

The world (and its quantitative easings) is being sustained by the ongoing gentrification of the Chinese workforce. This is by its very nature temporary. When this absurdity crashes, so will Wandoan.