A revised method of calculating changes to inflation made by the Australian Bureau of Statistics shows that the inflationary measures that most influence the Reserve Bank are lower than previously calculated. The ABS describes the changes – designed to take a better account of seasonal factors in prices – in a paper Seasonal Adjustment of Consumer Price Indexes, 2011 released today.

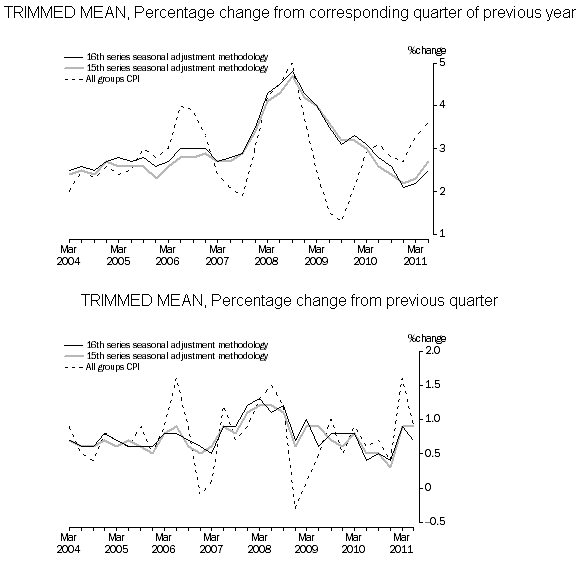

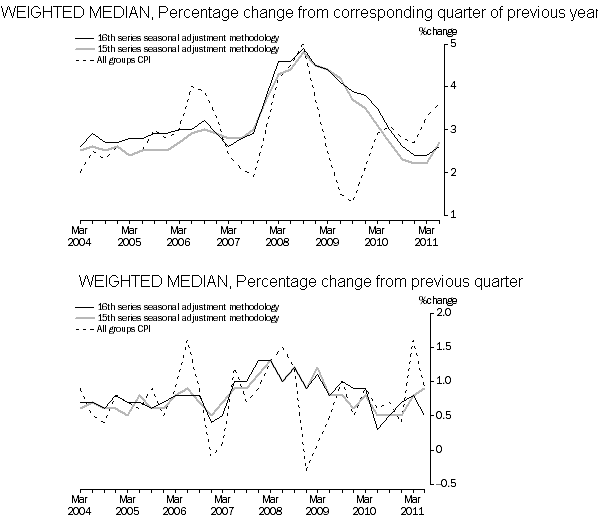

In a preface to the paper the ABS explains that in the June quarter 2007, it began including two analytical measures of underlying inflation – the Trimmed mean and Weighted median – using seasonally adjusted data in its quarterly Consumer Price Index release. These measures, which abstract from short-term volatility, are considered useful in identifying underlying trends of price level change and were developed by the Reserve Bank of Australia (RBA).

In December 2010, the ABS completed an extensive review of the Australian Consumer Price Index (CPI) and announced changes to ensure the CPI continues to meet the requirements of the Australian community. The review recommended replacing the 15th series seasonal adjustment methodology used to calculate the underlying trend inflation measures with a methodology using standard ABS practices. …

From the commencement of the 16th series CPI in the September quarter 2011, the ABS will introduce a new 16th series seasonal adjustment methodology to identify and adjust for seasonality. This will replace the 15th series seasonal adjustment methodology.

The non-seasonally adjusted All groups CPI, weighted average of eight capital cities is the official inflation measure. It is not subject to revision. The seasonally adjusted measures will show small revisions from quarter to quarter as the seasonal factors are updated using the latest available data.

The explanatory document of the ABS includes a comparison of the measures of inflation under its old (the 15th) methodology and the new (the 16th).

Both of the new measures of inflation are now clearly well under the Reserve Bank’s target of keeping inflation at under 3%.

Both of the new measures of inflation are now clearly well under the Reserve Bank’s target of keeping inflation at under 3%.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.