Every week, 215,000 Australians lurch awake to a buzzing alarm, put some pants on and head off to work at one of Bob Every’s companies.

The vast majority of the waged army toils inside the former Coles empire — Coles supermarkets, Kmart, Target and Officeworks — that for the last five years has been owned by the ASX giant Wesfarmers, which Every chairs.

The Perth-based behemoth is now Australia’s largest private sector employer — a retail empire spanning every state and territory. The $20 billion Coles deal went down just after Every, a trained metallurgist, joined the board as a director in 2006 following a long corporate career ending at BHP and its spun-off steel arm OneSteel.

Criticised by shareholders at the time, the tie-up is now beginning to bear fruit; a stroke of Every’s pen can mean big ructions down the line as his coterie of millionaire CEOs — big names like Coles CEO Ian “the Scotsman” McLeod and Kmart’s Guy Russo — decide who to hire and fire to fit with the strategic plan.

With so many lives at stake, it’s that raw human resources power that puts the even-tempered Every inside The Power Index‘s top 10. He also oversees struggling building products giant Boral, placing him among a rare club of ASX directors who chair two or more listed firms.

The transition from the corner office to boardroom has been a smooth one for the practical 67-year-old, who was awarded an Order of Australia earlier this year for his work chairing and raising thousands of dollars for child cancer charity Redkite.

“Power is a strange word, I’m more motivated by respect,” Every told the Power Index, echoing most of the other directors we’ve spoken to who are reluctant to spruik their own influence.

He says that while the coalface decisions inside Wesfarmers are made by his long-serving MD Richard Goyder in line with classic management theory (“you’re no longer the doer you’re more the listener, the coach and the mentor”) the implications of the 2010 Centro ruling — which infers directors, especially chairs, need to be more hands on if they’re to avoid penalties from corporate regulators in the event of a collapse — means he now has to delve a bit deeper.

“Your relationship with the CEO is important to the efficient functioning of the organisation … that link is the link between the board and management,” he said. “You have to peel enough of the onion … so you can’t take your hands totally off the wheel … the board’s role is still to review and monitor but being a monitor these days means drilling quite deep.” It’s an appropriate mixed metaphor given Every’s lifelong obsession with iron ore.

The Australian Shareholders’ Association says Every is “quiet, authoritative and strong in his requirements and beliefs”, but like many directors in our top 10 list they sound a note of caution over the potential for overwork. “He’s got a limited portfolio … however there’s also a significant time requirement in chairmanship of Wesfarmers as the largest employer in a diverse business, and in Boral, which is under stress in the current economic environment,” ASA CEO Vas Kolesnikoff said.

It’s true that without Wesfarmers, which made a huge $2.162 billion profit this year off the back of Coles’ “down down, prices are down” resurgence, Every wouldn’t trouble the scorers. Boral, by contrast, made a comparatively paltry (but still rather impressive) $176.6 million.

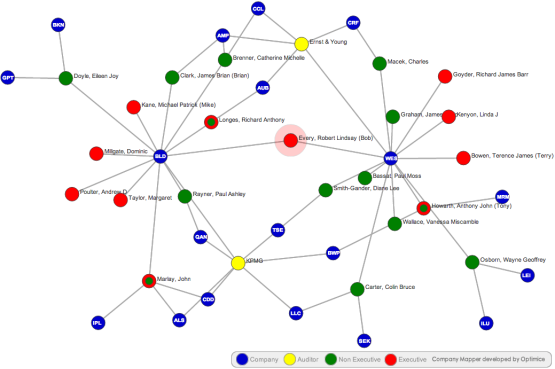

Every comes in at No. 346 on the Optimice Market Capitalisation Influence Index — ranking the total market cap of his boards — and No. 320 on the MCII Boardroom Connections index, measuring the combined market cap controlled by the 17 fellow board members across his two companies.

Remuneration has been weighing on Every’s mind of late. Departed Boral CEO Mark Selway snagged $1.89 million for a total 2012 salary of $7.35 million, recalling the bad old days under Ken Moss’ leadership when protest votes were legion. The process of replacing Selway — who lost the support of Every and the rest of the board– with new CEO Mark Kane was an “enormous time commitment”.

And over at Wesfarmers, Goyder (paid $8 million in 2011-12) and McLeod ($14.8 million) walked away with pay bonanzas this year, amounts Every — who chairs the remuneration committee — argues are in line with ASX norms.

He’s unsurprisingly not a fan of the government’s “two strikes” rule as a check on power, which he reckons can be marshalled as a “stalking horse” for other issues. In 2008, some 48.8% of shareholders voted against or abstained from Wesfarmers’ pay resolution and ever since he’s made sure to make nice with major shareholders prior to the AGM.

The Power Index asked about that perennial hunch of shoppers: are Coles and Woolworths really cutting each other’s throats in the grocery game or, aside from the occasional “price war” over milk and eggs, are they exploiting their duopoly to force the public to pay $9 a kilo for red capsicums? “No, I don’t buy into that,” he responded. “When you think about Australia with its enormous geographic size and small population, you really have to have scale; what we’re all about is bringing people quality food at lower prices.”

Interestingly, when asked for highlights over the past year, Every steers away from his corporate gigs and talks about the money raised at Redkite and for his alumnus, the University of NSW, where he’s helped build a School of Materials Science and Engineering in league with David Gonski’s UNSW Council.

Those lower profile, but perhaps more meaningful, gigs are the ones that make the difference. “You should be doing it for a genuine motivation not doing it for trophy points,” he said bluntly.

It’s the sort of steely resolve that makes Every our No. 7 most powerful director.

Bob Every directorships:

- Corporate: Wesfarmers (chair), Boral (chair), O’Connell Street Associates, OCA Services

- Not-for-profit/government: Redkite (chair), The University of NSW School of Materials Science and Engineering

Bob Every’s ASX connections — click to enlarge

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.