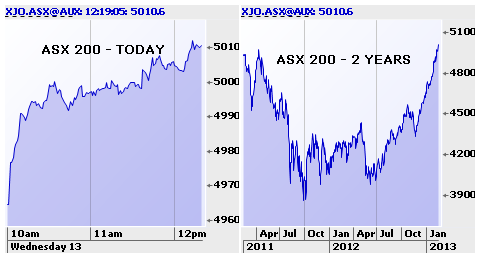

The Market is up 51 and has hit 5010 on the ASX 200 and 5029 on the All Ords. Dow Jones was up 47. SFE Futures were up 1 this morning. Twenty five points of the rise today has come from the big four banks which are up after the CBA paid a bigger dividend than expected.

The Dow was up 67 at best and down two at worst ahead of President Obama’s State of the Union address scheduled to take place at 9pm Washington time. European market up — UK FTSE up 0.98%, German DAX up 0.35%, France up 0.99%, Spain up 1.93%, Italy up 0.69%. Metals up — Copper up 0.42%, Nickel up 1.12%, Aluminium up 0.73%, Zinc up 0.82%. Spot iron ore unchanged at $155.10.

- CBA — 1H13 Net profit of $3.66 billion up 1% and slightly above an expected $3.621 billion. Cash profit of $3.78 billion up 6%. Interim dividend of $1.64c up 20%. CBA is up 2.41% to 6710c.

- Leighton Holdings (LEI) — FY12 NPAT $450.1 million versus a loss of $285.5 million in FY11. The result was above an expected $410 million. Final dividend of 60c. Work in Hand totalled $43.5 billion. LEI is up 5.24% to 2190c.

- CSL – 1H Net profit of $US626.9 million up 26% and above an expected $US602.5 million. Interim dividend US50c. CSL is up 1.5% to 5808c.

- Computershare (CPU) — 1H13 Net profit of $US94.6 million down 15.2%. Profit as per management adjusted results was $149.3 million above an expected 144.5 million. Interim dividend of 14c. CPU is up 2.23% to 1029c.

- OZ Minerals (OZL) — FY12 NPAT of $152 million down 122.5% but above an expected $149.2 million. Final dividend of 20c. Cash balance of $659 million. OZL is up 2.77% to 741c.

- WorleyParsons (WOR) — 1H Net profit of $155.1 million up 2.1% but below an expected $172.1 million. Dividend of 41.5c. Expects FY13 results to improve towards the end of 1H. WOR is down 1.66% to 2495c.

- Ansell (ANN) — 1H Net Profit of $55 million down 15.3% and below an expected $68.6 million. Dividend 16c. ANN is down 6.56% to 1581c.

- Stockland Group (SGP) — 1H Net loss of $147.1 million down 148% includes impairment charges. Underlying profit of $255 million down 26% and below an expected $274.9 million. Interim distribution of 12c. Confirmed FY distribution of 24c. SGP is up 2.3% to 356c.

- Goodman Fielder (GFF) — 1H Net profit of $51 million up 137% and below an expected $59.3 million Underlying profit down 4%. GFF is down 5.9% to 67c.

- Boral Holdings (BLD) — 1H13 Net loss of $25.3m which includes one off restructuring cost of $77 million. NPAT before cost was $52.2 million in line with an expected profit of $52 million. Dividend of 5c. BLD is down 0.82% to 490c.

- Carsales.Com (CRZ) — NPAT of $33.1 million up 14% and a record result but have run hard. Dividend 12.7c. CRZ is down 2.9% to 854c.

- Domino’s Pizza (DMP) — Net profit of $14.5 million up 15.7% but they report a slowing in like for like sales. DMP is down 3.8% to 991c.

- Skilled Group (SKE) — NPAT of $28.2 million up 23.1% and above an expected $27 million. Interim dividend of 7c. SKE is up 3.36% to 308c.

- Northern Star Resources (NST) — Net profit up 78% to $22.3 million. Interim dividend of 1c. NST is up 1.99% to 102.5c.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.