If you believe some employers and the business lobby, penalty rates can kill just about anything: employment, shift lengths, business, Sunday trading, cheap shopping — even the economy itself. Restaurants, in particular, have become a cause celebre for the reduction of weekend and evening rates.

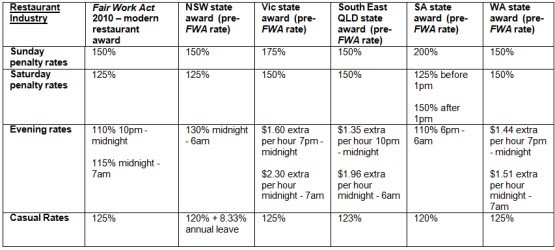

But newly compiled Department of Education, Employment and Workplace Relations figures cast doubt on whether the restaurant and food industry penalty rates are any higher under the Fair Work Act’s modern awards (introduced in 2010) than under preceding state awards.

DEEWR’s submission to the Senate penalty rate inquiry compares current penalty rates under the harmonised award scheme with pre-2010 state-based awards (the old awards did not cover every employer in the industry, but DEEWR says they are the most commonly used awards). Here’s an abbreviated version of the data …

Table 1: restaurant industry (click to enlarge)

Despite all the fuss, the figures suggests penalty rates are not significantly higher under the Fair Work Act than they were under previous regimes in some states, and are actually lower now than they were for many employers in South Australia and Queensland under the old fragmented system. Compare this to claims made in The Australian about restaurants suffering under the Fair Work Act’s harmonised award scheme.

There is no shortage of restaurant owners crying foul either. All the while ABS figures show the restaurant trade has been one of the fastest growing industries since 2007 (despite complaints by millionaire MasterChef judges). Take this Melbourne business owner, who wrote to the Senate inquiry:

“My labour costs have been spiralling and blown out since the introduction of the restaurant industry award regulating wages and penalty rates. Not only is it now getting to the point that my business may not survive but if penalty rates were abolished, my business would be more viable on the weekends and I would consider hiring more employees.”

Yet, if his staff were covered by the old state award he would be better off under the Fair Work Act.

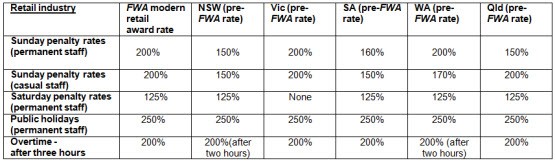

Retailers also say penalty rates are hurting them, especially when demands for 24/7 shopping are on the increase and shoppers are switching to online. In an Australian Newsagents’ Federation survey, 45% of respondent newsagents said their penalty rates had “substantially increased” under new awards. Myer told a Productivity Commission inquiry that modern award penalty rates are costing it an extra $10-15 million a year.

But unless you’re doing business in NSW, SA and Queensland, the claims don’t quite match the data.

Table 2: retail industry (click to enlarge)

One industry which isn’t struggling at all is fast food, although it too complains about rising labour costs. The Australian Chamber of Commerce and Industry told the Senate’s penalty rate inquiry: “Some fast food operators have indicated that the modern award will increase labour costs by $1896 per week or $98,600 per year — an increase of 34.5% total labour costs.”

The precision of the figures leaves an impression of accuracy. But does it stack up? Not according to DEEWR.

Table 3: fast food industry (click to enlarge)

It’s also important to note that only about 50% of workers in the retail, restaurant and fast-food industries are covered by awards. The rest are in industry agreements, allowing for penalty rates to be offset against other benefits or traded in negotiations (although they must leave the worker “better-off overall” in order to be approved by the Fair Work Commission).

Average turnover in all these industries is between 25-40% higher on weekends.

“My labour costs have been spiralling and blown out since the introduction of the restaurant industry award regulating wages and penalty rates.” Pity, he will have to trade in the Merc for a Lexus this year. Come 2014, and possible LNP win, it will be Rollers all round be they restraunteurs, mining magnates or the humble Macca’s franchiser’s, all will win under the Abbott work choices Mark 2 (can’t say the same for those who earn them their millions).

Capitalism, the “ism” that keeps on giving (to some).

I never quite understand why the philanthropists who don’t feel capable of running a profitable business persist? Is it because they love food, or they love dealing with people, making them happy, feeding them? Do they feel an obligation to raise the level of culinary art in Australia?

I mean, if it’s so tough (or you’re so bad at running a business), why persist? Why not sell the joint and go get a job like the rest of us?

Could it be that the truth of the matter is that when you run a small business you can easily structure your tax arrangements so that your effective take home is pretty nice thank you very much. Could it be that things that wage earners accept as their personal expenses, you can claim as a business expense. Frinstance, I’d love to see a breakdown of how many 100k plus cars are privately owned as opposed to either owned by a business or the subject of a significant tax claim.

And while I’m on my hind legs, why don’t I hear complaints about the cost of rent or increases in olive oil prices or other things. Why does the price of paying people a decent wage, s#!+ hospitality owners so much?

Are they just greedy, dishonest, narcissistic whingers?

So much for the ‘no disadvantage test’…

It is a given in at least some parts of the industry, probably most, that it is impossible to run a restaurant or cafe/eatery at a profit under the exhaustive regime of taxes and wages, having to pay suppliers etc, and therefore they must cheat to survive.

It smacks of one of those rationalisations that people make to justify what is illegal, and often unethical behaviour.

I suspect, as SBH implies, that their culinary skills far exceed their business and arithmetical skills.

Sure, it’s a tough industry and for some it is unviable, but I can’t help feeling that many are making huge money and again, as SBH highlights, reporting low to average incomes and profits.

There are lurks, legitimate and otherwise, aplenty in small business.

And strangely I never hear a peep out of them for what constitutes a significant part of their expenses, that being rent. I can tell you that commercial rents are substantial, and perhaps entering into unviable rental agreements was the problem, not the fact that you have to pay staff.

But they would never raise their voice against the landlord, you can’t bully him.