Tired of being slugged by the government every time you go to the shops? Sick of Wayne Swan reaching into your pocket every time you purchase something? Well, relief is at hand.

As it turns out, compared with most other major economies, Australians are lightly taxed at the cash register. On some products, we’re taxed way below international averages.

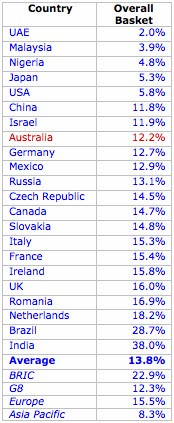

International accounting outfit UHY Haines Norton undertook a survey of taxes on a basket of goods across 23 economies. The results further undermine the notion that Australians are highly taxed. They also undermine the excuse used by some transnational manufacturers like Apple and Microsoft that “local taxes” are a reason why prices for their products are always substantially higher in Australia than in larger markets.

The basket of goods used by UHY included staples like bread, petrol and clothing as well as wine, chocolate, newspapers, iPods and iPads, restaurant meals and air travel. The methodology has some flaws: it doesn’t capture US state taxes, for example, which can significantly inflate the cost of products for US consumers, and it doesn’t track the impact of upstream taxes like Europe’s or California’s emissions trading scheme or Australia’s carbon price down to the final consumer price. Nonetheless, the comparison puts to rest some myths.

For example, Australia compares particularly favourably on petrol, where the taxation level of 26.5% is well below the international average of 36%, although we’re way over the international average on cigarettes (67.1%, compared with 51.25%) and air travel (27.6%, compared with 11.14%).

And despite the claims from the preventive health lobby that we need to increase the tax on wine, Australians actually pay more tax for wine on average than other drinkers around the world. We pay 24%, compared with an international average of 23.45%, and we pay far more tax on wine than Americans, Canadians, Germans, French and Italians. The advocates of higher wine taxes might need to explain why we drink more than twice as much wine as Americans when the latter pay only a third of the tax we do.

For MP3 players — or iPods as everyone else calls them — Australia’s GST means we pay less tax on average (11.24%) than other countries, much less than the UK (16.7%), France and Germany and less than Canada (11.5%). Which makes it hard to understand why you can purchase an iPod touch in the UK for the equivalent of $254, while it would cost $329 here. Or pick one up in Canada for the equivalent of $288.

There’s presumably a good explanation from Apple for that.

I’m sure it’s the same explanation BMW, Audi and Mercedes have for putting a 40%+ premium on their cars here – because they can.