Re-crunching Treasury numbers

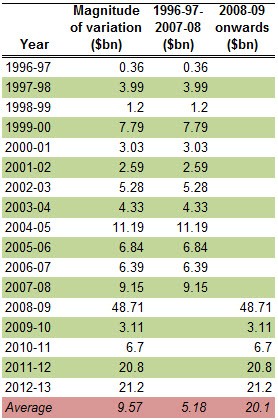

Martin Gordon writes: Re. “Forecasts: how wrong will Treasury get it this year?“ (yesterday). The reputation of Treasury has taken a battering of late over its budget estimates. I think the methodology of Andrew Crook yesterday is a bit too kind to Treasury, by unders and overs in effect cancelling out, producing an enviable average. It would be sounder to use magnitudes of error which disregard direction. Using that basis Treasury used to do pretty well; about $5.2 billion average over the first 12 years, but a woeful average of late at $20.1 billion over the last five years.

Treasury might have a better result in 2013-14? The last two years have had errors greater than 1% of GDP each year. Bernard Keane made a good point about “savings” actually being tax rises and in large part from economic recovery. The actual budget savings are pretty small.

Wayne Swan a great Treasurer?

Terry Dear writes: Re. “Swan’s mixed legacy as an economic and fiscal manager” (yesterday). For a man who clearly can’t count, can’t forecast and can’t get the most basics settings right, how on earth could Wayne Swan a better treasurer than Peter Costello? I know it will be unpopular for the Crikey comrades, but Costello was the reason there was prudential regulation put in place so Australia did not have the bank issues that poisoned a lot of other economies. Swan, for all who fawn over his ability to manage the GFC, had the position of having $22 billion in the bank when he took over.

Where does foreign aid go?

Niall Clugston writes: Re. “Foreign affairs: Defence spending down, more aid and spies” (yesterday). Amid the furore about Australia failing to meet its foreign aid targets in the federal budget, it is important to note that much of this aid does not go to the poorest of the earth. Rather it supports Australian business interests in the Asia-Pacific. Savings in this area can be seen in terms of the general budget theme of giving less help to those who can help themselves.

Why do we need media diversification …..?