While Canberra, and a lot of journalists who should know better, talk about the benefits of (inaptly named) “free trade deals”, it pays to remember that the biggest wins from trade agreements almost always arise from the barriers we ourselves remove in our own economy, rather than the barriers the other party removes.

Similarly, while we might focus on what the Richard Di Natale-led Greens extracted from the government to support its age pension changes (hint: basically nothing), the real issue is the broader benefit it will achieve. As the government itself is happy to admit, the changes reverse the ridiculously generous adjustments to taper rates for part-pensioners, introduced by a desperate Howard government in 2007 as part of its Rudd-induced strategy to buy another term in office. It was bad policy then, and reversing it is good policy now.

Wealthy part-pensioners will therefore go back to the pre-2007 tapering arrangements, based on lower asset thresholds.

Sadly, it’s a replacement for another piece of good policy, the “age of entitlement” era decision to reduce age pension indexation to a lower level, a gutsy decision for a party that relies heavily on pensioners as the core of its public support. Both measures are justified, as is the dumping of seniors’ supplement that Labor has agreed to — another piece of Howard-era largesse long past its use-by date.

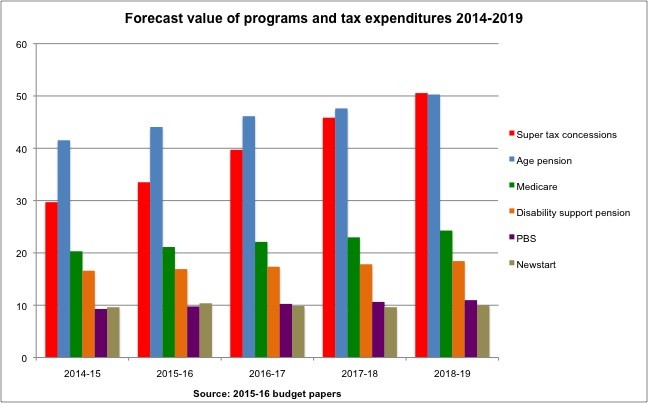

The objection of Labor and some seniors’ groups to the asset test and taper rate changes is that it is fiscal discipline (around $3 billion a year in total) at the expense of middle-income pensioners, i.e. those too wealthy to be on the full pension but who weren’t wealthy enough to fully fund their own retirement. This of course is true, though not an excuse to oppose the government’s changes. Yes, the government is being unfair and fiscally irresponsible in failing to address the extensive handouts it provides via the tax concession system to wealthy superannuants. Just because they’re retirees doesn’t mean they shouldn’t pay at least some fraction of the level of tax on their earnings that the rest of us face. As Crikey has demonstrated before, super tax concessions are the least sustainable expenditure in the budget, far bigger and growing far more quickly than various other “unsustainable” expenditures.

The problem isn’t merely that a desperate Tony Abbott is resistant to super tax changes because he wants to portray Labor as the party of higher taxes (despite massively increasing the amount of tax he’s taking from us as a proportion of GDP); it’s that self-funded retirees are the inner sanctum of the Liberal Party base, more so than pensioners, and the big banks are key supporters of the Coalition. Both banks and self-funded retirees will look askance at any proposal that would have them rolling in less untaxed cash than they do currently.

But this is perfect-is-the-enemy-of-the-good stuff, of which the Greens are frequently accused. Rather than allow the government’s stupidity on super tax handouts to prevent them from supporting policy that is sensible in itself, they’ve allowed it through.

With any luck, the Greens will now have a change of heart on the government’s efforts to reverse another appalling and costly Howard decision, to dump fuel excise indexation. That has cost the budget tens of billions in lost revenue since 2001. The Greens would prefer the revenue go toward public transport, rather than into a notional road-building hypothecation fund that the government thought would provide a political fig leaf for the tax rise. It’s an argument over a fiction, and no basis on which to oppose a sensible measure.

For mine this is the last straw with the Greens – so needy in terms of attention. And so easy to fool – they have done in their natural middle of the roaders who have gone to the trouble of salary sacrificing for years and years – just to see it washed away, without any affect on the truly rich creaming the negative gearing and other tax breaks.

They are dead – watch out Brandt we are in your electorate.

It does seem unfair on those singles who are just over the edge of the assets test which is not hard to do if you count the car and your possessions, a bank account with a few thousand in it for rainy days and $500000 in super which does not produce very much income. People in this position are by no means rich but will lose thousands in income

This is the Greens’ ‘GST’ moment. There’s no mileage in this for them, but they will cop all the criticism.

And er, didn’t they vote against the re-introduction of fuel excise indexation recently?

And let’s not forget that the Greens got absolutely nothing in return for the environment out of this. The Greens are on the record as saying that it is not appropriate to horse trade over unrelated policy items. That’s right folks, the Greens don’t think they should force Abbott to concede ground on a single issue of the environment in return for their vote on virtually any policy. That BK doesn’t make that the centre of this story just goes to show of how little importance BK and his mates in the Greens actually place on environmental outcomes. The Watermelon Party strikes again.

Moreover, it’s not even good economic policy as virtually every single person effected by this was planning on using those savings to pay the 250-500K bond needed for a half decent aged care placement in their final years. But let’s face it, old people don’t vote for the Greens and given many of the people impacted by this “fiscal reform” are former school teachers and other state, federal and local govt public servants – who don’t vote for the Libs either, you can safely say this was a zero political risk measure for both the Libs and the Green.

It does seem unfair on those singles who are just over the edge of the assets test which is not hard to do if you count the car and your possessions, a bank account with a few thousand in it for rainy days and $500000 in super which does not produce very much income. People in this position are by no means rich but will lose thousands in income

If you have half a million dollars in superannuation, you are probably in the wealthiest 10% of the country.