The annual round-up of fund performance across the superannuation sector will alarm the government because of what appears to be a growing gap between the performance of industry super funds and retail super funds.

A review of fund performance by Chant West shows strong returns for the whole sector in 2017, which is good news for every Australian with a super fund. Its top ten major performers list was dominated by industry super funds, which are run by nominees of employer groups and trade unions.

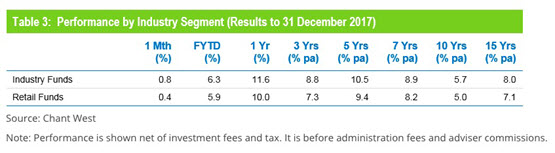

Chant West also noted that industry super funds had again outperformed retail super funds, which are controlled by the big banks and AMP.

One reason for the outperformance can be found elsewhere in Chant West’s report: unlisted infrastructure, along with shares, has been a strongly performing asset class in recent years, and industry super has repeatedly been willing to invest in infrastructure when retail funds have avoided it.

But while even the enemies of industry super in the Liberal Party and in the media have reluctantly acknowledged they outperform retail funds, the 2017 results suggest that the performance gap is getting wider.

Back in 2015, the one-year, three-year and five year performance gaps between industry and retail funds were 1.5, 0.4 and 0.3 percentage points.

In 2016, the gaps were 1.3, 1 and 0.5 points.

Last year they were 1.6, 1.5 and 0.5 points.

Even small differences in performance will translate into superannuation sums tens of thousands of dollars lower than they otherwise might have been when a retail fund member retires.

The government remains committed to its war on industry super funds, and is still hoping to remove the employer-employee governance model and shift it toward big bank-style governance rules for boards. It is also searching for a way to end the self-created stalemate on super choice in awards that has locked retail super funds out of accessing new funds. The government has also coordinated a media attack on industry super funds with News Corp journalists in an effort to portray industry funds as corrupt, with the sector always portrayed as union-controlled rather than jointly run by employers and unions. In 2016, Treasurer Scott Morrison actually attacked industry funds for not investing in infrastructure when the sector’s infrastructure investments were many multiples of retail funds.

Expect that government campaign to grow ever louder as industry funds widen the gap with their big bank rivals.

The LNP coalition should change it’s name to better reflect their “values” to The Corporate Coalition. The best politicians that money can buy.

Please leave that comment on twitter it is so apt I hope You don’t mind if I use it once in awhile Thanks Kaaren

It’s disgraceful that the industry super funds corruptly fail to siphon off members’ contributions to overpaid CEOs. Something should be done about it.

If the LNP’s Scott Morrison could find a way He’d do it!!!!!!!!!!

And yes folks, Kelly “I’m the dolt from Higgins” O’Dwyer wants to do to Industry Super funds what Tony rAbbott his then flunkey Malfeasance Turnbull did to the NBN. A total NBN fuck-up. It looks as if the successful Industry Superfunds are in for the same LNP we’ll fuck it up treatment. As for an economic crime against hard working Australians the Malfeasance Turnbull NBN policy must surely take the cake.

Don’t they hate it that they can’t steal that money from that big honeypot.

That’s why they have to nobble it – management tainted by inclusion of “workers” being able to manage better than “big biz” professionals?

What this could mean to the rest of civilisation as we know it.

All those on such obscene wages (for such lean comparative productivity?) being outdone by the hoi polloi?

They have to open these funds to pillaging by the corporate sector/donors – for a return on their “investment”?

Meanwhile Rupert’s media throwbacks are devoted to one side of politics – pimping his/Turnbull’s Limited News Party. “Battler” Rupert who rails against “the establishment” while ensconced deep within it’s affluent bosom.

With his foreign entity meddling in Australian politics to produce an electoral outcome : but in this circumstance that’s all right with Malfoy Turnbull.