When it was revealed last June that former defence minister Christopher Pyne had been appointed a “strategic adviser” to big four consulting firm Ernst & Young — these days calling itself EY — there was widespread outrage.

Pyne, who ended a long political career at last year’s election, was to advise EY on lifting its defence contracts. “I am looking forward to providing strategic advice to EY as the firm looks to expand its footprint in the defence industry,” he said at the time.

The former high-profile Liberal moderate was later at pains to assure people, via a glowing Australian profile, that he wasn’t actually lobbying anyone on behalf of EY, just giving it advice.

A year on, has Pyne’s advice begun delivering for the multinational firm, best known for its massive tax avoidance schemes? It seems it has yet to convert Pyne’s wise words into improving its defence tender game.

Based on publication dates of contracts on the Austender website — a flawed source of information but at least consistent over time — EY is the also-ran of government contracts among the big four consultancy firms, which are also some of the biggest political donors in Australia.

In 2019 it secured “only” $86.2 million worth of contracts. That was down on $103 million in 2018, although 2019 was an election year when the caretaker period and the arrival of new ministers tends to slow the heavy volume of cash flowing to consultants.

EY’s $86.2 million compares with $205 million for consultancy king KPMG (also down, from $250 million), and $176 million and $160 million respectively for PwC and Deloitte.

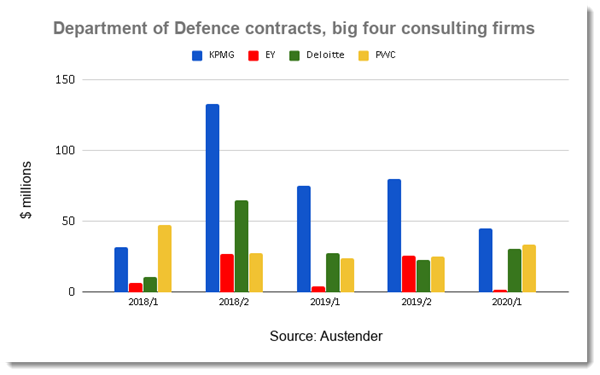

And, as Pyne’s appointment revealed and Crikey reported at the time, EY is also a distant last when it came to defence contracts. In 2018, for example, EY managed about $33 million in contracts with defence (not including the Australians Signals Directorate) compared with $164 million for KPMG and about $75 million each for Deloitte and PwC.

Pyne’s advice seemed to have an immediate impact at EY: having secured only $4.3 million in defence contracts in the first six months of 2019, that lifted to $26 million in the second half.

Except that second-half performance was about the same as the second half of 2018, when it earned $27 million in contracts. Still, EY’s performance compared favourably to Deloitte and PwC, which earned contracts worth $23 million and $25 million respectively. KPMG secured nearly $45 million.

But if there was any Pyne magic it vanished in 2020.

With the end of financial year in sight, EY has managed just $1.4 million in contracts from Russell Hill. Part of that is undoubtedly due to the impact of COVID-19, which has led to cutbacks, pay reductions and four-day weeks at the big four.

But the impact wasn’t consistent. Next lowest was Deloitte with just over $30 million from defence — its best result since 2018 — then PwC with $34 million — also an increase from 2019 — and KPMG with nearly $45 million.

That means that after nearly a year benefiting from Pyne’s advice, EY has managed only $27 million from defence, while Deloitte managed $53 million, PwC $59 million and KPMG $124 million.

Across the public service, according to Austender, so far the big four firms have billed taxpayers about $280 million this year — down on $347 million in the second half of last year, but about the same as the first half of last year.

COVID-19 has had an impact, but this government can always be relied on to keep the cash flowing to its major donors.

Why do you insist on calling these glorified accountants “Consultants”?

I work for a consulting engineering firm, and we work on real projects which actually produce something concrete (sorry, no pun intended) for the community. EY and their ilk simply clip the ticket on the way to confirming that they can determine the cost of anything, but the value of nothing, and telling politicians what they want to hear.

Furthermore, it comes as no surprise to learn that Christopher (“I’m a fixer”) Pyne hasn’t really delivered for EY.

@BERNARDKEANE Do these figures include their CASG MSP partnership with KBR?