Some of us have long suspected the stockmarket is really just one giant casino, but recent trading activity during the pandemic would seem to confirm it.

How else to explain the correlation between increased activity from retail share traders in the market at the exact time traditional casinos and most popular gambling outlets were closed for lockdown?

They’re not called “punters” for nothing.

Add in the disturbing fact that many of these first timers were younger people during a period when half the nation was on government subsidies and it raises plenty of questions.

Surely all these new accounts betting on risky payday lending stocks could not possibly have come from JobKeeper or people accessing their superannuation early?

Well I might say that but the Australian Securities and Investment Commission (ASIC) couldn’t possibly comment.

Actually, they are happy to comment. Not about the possibility of youngsters gambling with government stimulus funds of course, that’s up to others to surmise, but ASIC is certainly keen to go public with its data. That data raises concerns about the source of funds, among other things.

ASIC senior executive leader for markets Calissa Aldridge explained to Crikey that they are “seeing continued high volume, speculation and younger participants”.

“The uptick in new entrants, the increased day trading means we are seeing shorter hold periods and increased participation among smaller stocks which are heavily traded,” she said.

It was the corporate regulator itself that first sounded the warning — it was contained in its latest update on retail trading trends since the beginning of the pandemic.

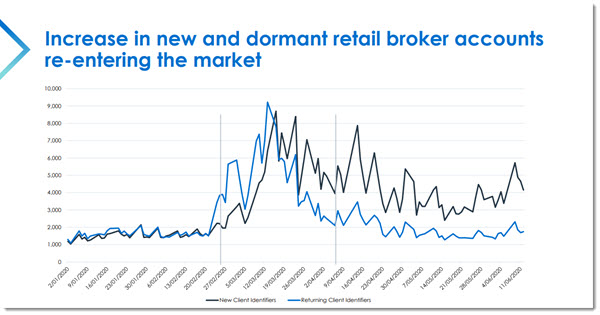

The data shows that retail participation is around twice the previous normal retail daily turnover before COVID-19 on February 21 — $2.8 billion in June compared with $1.6 billion.

Back in May ASIC rushed out a report showing that a swathe of new retail investors had entered the market and not surprisingly had made much of their dough during the initial market crash and volatility.

Since then of course the market has had an extraordinary bounce back which has not alleviated but only increased ASIC’s concerns as the pile-in continues, ableit at a slighter slower rate than the March peak.

It seems if the newbie investors needed to be warned when the market was crashing and they were losing money they need to be reminded of the risks when they are making money.

The rebound in the market means they might be well ahead now and that might be good in the short term but it could also have given them a false sense of security.

A bit like gamblers at the casino. Though these days the sharemarket “punters” are more commonly known as Robin Hood traders — after the US-based free trading app which has lured millions of young traders.

(It has also become a generic term for these new traders who not only utilise social media to ramp the stocks but, in one case reported in the financial press, employ such low-tech concepts as throwing out Scrabble tiles and trading stocks starting from whatever letter comes up.)

While the Robin Hood-style apps are not available in Australia where trading is more strictly regulated, the ASIC data shows young people are nonetheless piling into the market into predominantly cheap stocks.

Not surprisingly the younger demographic also favours the risky tech sector, with Afterpay and Zip Co particular favorites. Even though no longer cheap, the dramatic rise in share value and attraction for inexperienced investors is being closely monitored by ASIC.

Aldridge notes that among the 255 stocks ASIC surveyed, 70% had tripled in price, yet 80% of them had no earnings.

It sounds reminiscent of the great “tech wreck” of the early millennium for those old enough to remember. And those even older point to the quintessential Australian stock bubble in the Poseidon mining boom in 1970.

So you could argue that it has always been thus. Penny dreadful stocks have always been popular with the small investors and form a key part of the Australian mining sector.

Bubbles predate the tech boom — the Poseidon bubble, the South Sea bubble, the great Tulip bubble. Though in those days they didn’t have virulent and unsubstantiated social media to fuel them.

For, despite well-deserved criticism of the efficacy of the corporate regulator, it is impossible to legislate against greed.

You can just remind everyone that even the most respectable markets can resemble a casino. More so during a pandemic flush with government funds, it would seem.

Does the regulator need to step in on new investors taking risky punts? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publishing in Crikey‘s Your Say column.

All Ordinaries go brrr

Any moderately sane person, with patience, cnaplay the market. Those in the middle of it are consumed by the micro, and making up stories to explain the macro, it’s a total crapshoot.