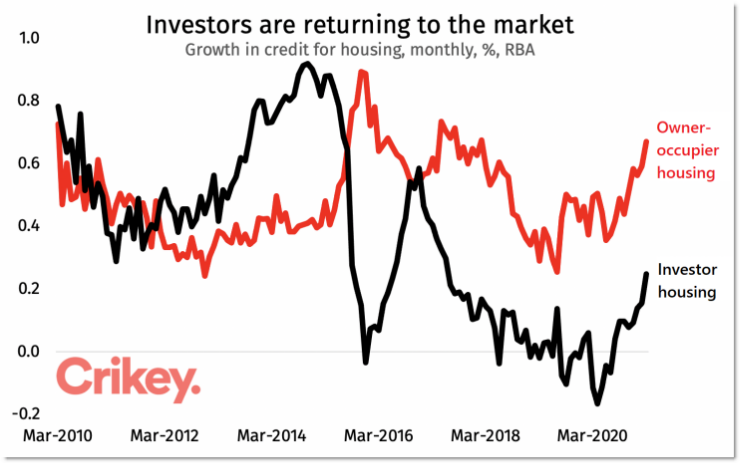

When the Australian housing market wobbled in 2017-18, property investors slunk away. They didn’t return immediately, and when the market looked unsteady again in the pandemic investors were nowhere to be found. Auctions were full of people who — unbelievably — actually wanted to live in the home they were buying.

But now, as the graph above shows, property investors are coming back. A hot housing market attracts investors like a drop of blood attracts sharks. Why? God knows it’s not about the rental yields. The yield on renting out a property in Australia can be under 3% — a terrible return for the effort. Many property investors lose money on the renting side — that’s what negative gearing is, after all.

Nope, for Australian housing investors it is all about price appreciation, and the generous capital gains tax discounts they can get. Low mortgage interest rates let prospective owner occupiers borrow more, prices rise, and that brings the investors back to the game. And on it goes…

I have been wrong so many times about the ‘inevitable’ housing Ponzi Scheme crash that’s ‘just around the corner’ that I no longer trust my own head or gut instinct an inch. What on earth is going on – shorely the party has to end sooner or later…?!?!

Don’t we have to saturate the investment numbers, exhaust the capital gains (pace and scale), and run out of willing investors…at some point?

Agree, it just defies logic, not to mention gravity, entropy and plain horse sense.

Why do I continue to hope to sup Schadenfreude?

This low interest rates and housing price madness is central to the plan. All western economies are in the same phase. Catch all the little fishies in the debt trap then crash the stock markets and the housing market along with it. The IMF or an equivalent UN body then cancels all debt, personal or corporate, in return for all assets and cash being handed over to them. It’s called a “reset” or if you like. “Building Back Better.”..and it’s the Devil in the detail.

Wow, you mean that there is some method to this madness?

That it is not just madness?

That’s such a relief.

I, for one, welcome our SoyLent Green Overlords

As Homer said, “I have wife & children! Eat them first!”.

And as Homer also said. “it’s funny coz it’s true”.

That would indeed be a less than calamitous outcome, Macklyn, although not sure why the UN or IMF is required in this conspiracy. They don’t hold the debt, so won’t have any say in it. It could happen at national level though and that would do me fine. Presumably those without debt or who can pay it off can keep their assets, or is there more to this, or haven’t you read that far into the conspiracy to work that out.

On the other hand, your use of the terms reset and building back better suggest you’ve just drunk the conspiracy kool-aid.

I think it all comes back to supply and demand. While NSW housing supply is still 200,000 below demand, a bubble isn’t likely (its probably similar in the other states). There’s always someone wealthy or desperate enough to pay whatever the price is. I think the sh*t will really hit the fan when interest rates begin to rise.

All the “great economists” – retch – agree that interest rates are unlikely to rise, and certainly not substantially, in the foreseeable future.

Although we can see, from the record, how they are always, comprehensively, wrong about everything in this case it is for a reason they cannot, dare not admit because it is anathema to their pseudoreligious, clap trap, group think.

Put simply, as Bushy avers, there is simply far too much hot money rushing in ever decreasing circles around the world, seeking a return.

It is no longer a means of exchange or even a measure of value – ie a tool – but a commodity, like black bean husks or pork bellies.

Dare one say it, no longer servant but master?

Well, just every one of my friends has a theory on how the world works and very few are the same. Rather than looking for ‘reds under the bed’ every time you enter a room, I think it’s more instructive to see how other nations handle problems like housing.

The above was held up for three day by the moderators. WHY!

Is the term ‘r*ds under the bed’ now considered derogatory language rather than just a term used by the MSM all through the 50s and 60s? Pathetic Crikey.

Last week mine on the ATO persecution of Richard Boyle was also held up for 3 days. After the usual boilerplate no explanation I tired again was told, after a second request for elucidation, that it was because I’d made a typo. on the word “result” which gave the ModBot conniptions.

Any wonder serious people are dropping away from a publication with a pre high school reading age and kindi level analysis.

And that’s before the whiney woke wankerism which has enveloped it for the last month or more.

Yes, we do Jack, but this balloon currently has more people puffing it up than letting it run down, particularly effective if the government and the RBA are both spruikers.

Same goes for the sharemarket, another cataclysm awaiting us, but, you know, this time it’s different.

Again.

The low interest rate has lured investor money into real estate, as the capital gain will make more money and less payable tax then other investments at the moment. There really didn’t need to be any construction stimulus at all, it has just further distorted the market.

Think property also had much catching up to do after stagnation for several years which is not apparent if focus is upon nominal headline prices (versus real value accounting of all costs)?

‘The yield on renting out a property in Australia can be under 3% — a terrible return for the effort’

3% would be optimistic? Quite perverse the state supports given to the ‘business’ of residential property investment, for those willingly investing in an asset that loses value immediately, while not creating any future or innovative value for the Australian economy?

Further, the way housing or property data is presented in Australia via indirect indicators provided by insiders i.e. RE Institutes, CoreLogic, SQM, Domain/RE and spruikers is sub-optimal according to statistics 101. For example, presenting number of properties on market (ignoring private sales), asking prices/rents, auction clearance rates, aggregated headline data, etc. but no timely access to actual sales and prices paid, let alone primary data for independent analysis?

The metrics and analysis rond property in Australia is more about shaping perceptions bypassing statistics 101, linked also to terrible population and immigration data analysis/presentation claiming continued growth in population; ignores the coming baby boomer bubble passing through….. and the risks of the apt. market filtering into established housing markets in cities….

..and further.

Great article, Jason.