Born dodgy, continue dodgy: that’s the story of the Great Barrier Reef Foundation’s staggering $440 million handout from Josh Frydenberg in 2018, when the Turnbull government had some extra cash and decided it was a good idea to give it to a little-known body linked to business luminaries, including then-Business Council chair Grant King.

Now the auditor-general has looked at how the foundation has spent taxpayers’ money, and in particular whether it fulfilled its promise that it would magically leverage taxpayer funding into $300-400 millions of additional private sector funding.

The results, nearly halfway through the life of the funding project, make for grim reading. And they should also serve as a corrective to anyone who insists that the private sector automatically does things better than the government.

Among a host of criticisms of the foundation’s operations, the auditors identify two serious problems: deals done without any proper process, and what looks like a near total failure to fulfill the promise to generate extra funding from the private sector.

The lack of proper process started early, and from the very top. Mercer Investments approached two foundation directors with a proposal to manage the foundation’s investments and was selected on the board’s say-so, without any tender process. Another pick to manage investments, Laminar Capital, was chosen by a director after a “limited tender” process of just two applicants, and later allowed to bump up its fees for doing the same work, with a retrospective fee increase ticked off by the board.

When it came to disbursing money for reef-related activities, the foundation didn’t get much better. While about 71% of grants monies were handed out via competitive tender processes, the same proportion of procurement money was handed out without any competition to “sole source providers” — often to people known to foundation staff.

In total, 49% of the sole sourced procurements had previously been contracted by the foundation, with 24% having a personal or professional acquaintance of a foundation staff member and 9% being awarded to corporate partners of the foundation.

Alas, “the scope of this ANAO performance audit did not include the management of probity by the foundation, including in relation to how any conflicts of interest were identified and managed in undertaking procurement activities”.

Of 14 high-value procurements that, under its own rules, the foundation was supposed to put out to tender, only four had any sort of competition, with the foundation offering excuses like that it had to meet “a deadline not reasonably foreseen”. One $270,000 contract to develop a comms plan was handed out without any effort to check whether the fees were reasonable in what is a highly competitive market. One lucky firm, Clear Horizon Consulting, has received four contracts from the foundation worth $575,000, with only one of the contracts being subject to a tender process (limited to two firms).

Poor procurement is hardly limited to private sector bodies like the foundation — it’s rampant in the public sector too. But where the foundation was supposed to make a difference was that it was going to leverage taxpayer funding into much greater impact than would have been obtained just from spending the original $443 million grant or handing it to another government body (or the Queensland government). The well-connected business figures on the board would cleverly turn $443 million into — they said in a funding strategy agreed with the government — $800 million in funding, with $357 million in additional funding to be secured by June 2024.

The audit assessed them 40% of the way through the life of the funding, and those expansive promises have come to little. For a start, the foundation decided $200 million of the $357 million would be in-kind contributions, not cash. And the government agreed that much of this “leveraged” funding didn’t have to be private sector funding, but could be taxpayer funding from the Commonwealth itself and other governments.

How much in-kind funding did the foundation “leverage” in the first couple of years of operation? So far, around $53 million, little of which has actually been delivered — most of it is still only contracted to be received. That has “cost” the foundation over $134 million in grant funding — meaning it is leveraging less than 40 cents for every dollar it has spent. And around 15% of those contributions have come from taxpayers via other Commonwealth bodies.

Often times, “partners” promised in-kind contributions and they never made them, or contributed far less than agreed — though there was no contractual obligation imposed by the foundation to pay up in exchange for spending taxpayer money. In the second half of 2019, the foundation even stopped using these “co-investments” as a selection criteria for projects.

How about cash contributions, which are supposed to total $157 million over the six years to 2024? There’s a little way to go on that — the audit found they so far totalled $684,100. That includes $69,000 from the foundation’s US fundraising arm.

But the foundation has some explanations for why it’s going so poorly: it’s still in what it calls the “quiet phase” of its capital fundraising campaign; there was a federal election in 2019; COVID has ruined everything — and fundraising had been harmed by “negative media commentary relating to the grant process”.

But it’s all OK because, cleverly, the foundation has never established interim fundraising targets, so the ANAO couldn’t “assess whether appropriate progress is being made towards the fundraising targets”.

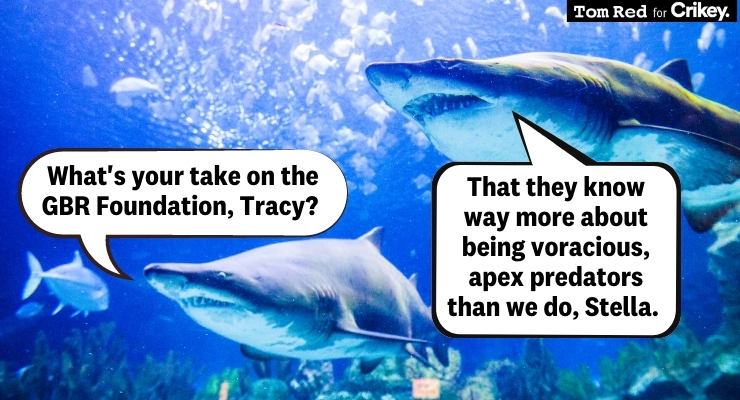

Possibly the other $300 million will come in a rush over the next three years. Or possibly the idea that a privately run outfit made up of business doyens could be relied on to deliver on its generous promises should always have been treated with scepticism.

So the financing record of the GBR Foundation is more or less a failure so far. Or is that too harsh a judgement? Maybe underachievement is a better description. But I had been wondering for some time what reef-saving projects had actually been financed by GBR Fndtn and had got off the ground – or into the water – as a direct result of this $440b munificence. After all it’s getting on for 3 years. Can anyone provide some details of the actual benefits to the GBR; there must be some.

There are some, the corporate donors of the Librorts Party are now a great deal richer than they previously were.

Bit harsh?

Some of that “benevolence” must surely have back-flowed the way of their political benefactors?

We tax-paying rubes can all take a bow – this wouldn’t have be possible without our oblivious participation – through this government channeling our $tax that way?

Thank you Malcolm…..

Probably that’s an “on water” matter.

Not “on water” clearly sunk without a trace!

This is no joking matter. It’s run much deeper than that – this is “under-water matters”.

I think it’s main purpose was to enable the LNP to claim that they cared about the reef, when in actual fact, many of their policies promoted reef destroying climate change. Adani, Abbott Pt, Carmichael Basin expansion, coal-fired power plants, etc. Since they got a swing in some Nth Queensland seats, I’m sure they’ll think it money well spent: even if the reef has nothing to show for it.

Lnp Keith Pitt recently knocked back solar and wind farm developments in Queensland, overruling I think NAÏF approval for funding. They love addressing climate change initiatives it seems….

Yes, I noticed that. It’s beyond idiocy.

… and Malcolm at the time was complaining about lack of money coming in to Libs from donors… he had to stump up $1m of his own for the previous election…. so what better way to get some gift taxpayers money to a foundation that could give it back as a political donation…

A failure for most but a chink-chink success for some.

As intended.

Did the ANAO follow up on any Talcum link – the odd consultancy or perhaps a useful introduction letter to some entity on the Cayman Islands?

Greenwashing PR…..

The $444,000,000 grant to the GBRF and the $498,000,000 to the Australian War Memorial to tear down a lovely Anzac Hall and replace it with a war toys theme park are the two matters of the A-T-M governments that infuriate me most. Money for mates, plain and simple.

A rort by any other name would stink just as badly as this. Turnbull, Frydenberg and friends belong in a banana republic.

Australian banana republicanism?

No one has ever accused Malcolm Turnbull of good judgement, have they?

This deal was dodgy and then turned shady and now possibly shonky.

Unfortunately if something is not downright “go to jail, illegal” then the LNP are not at all worried.

It’s getting farcical at this stage to see how much taxpayer money is being given to the private sector only to do a worse job. The contempt for the Australian electorate is only matched by the willingness of the voting public to keep electing the crony capitalists and perpetuate the corporate drain of the public purse.

But, hey, I suppose it’s better than the alternative – having capable public servants earning enough to live a middle class lifestyle.

There is a stench of graft and corruption about this LNP government of ours that just will no go away – whether it be by ‘grants’ to mates and donors or appointment of these same mates and donors to government Boards and Instrumentalities or Diplomatic postings