In years and decades to come, we’ll become aware of just what profound damage we’ve inflicted on ourselves by our lack of a decent housing policy under all sides and all levels of government in the past thirty years.

In the latest list of policy proposals from the Grattan Institute, an all-you-can-eat buffet of reforms across all major areas of economic and fiscal policy, the section on housing stands out for its detail on what our failure on housing policy is doing to Australians — and no longer just younger Australians, and no longer just poorer Australians.

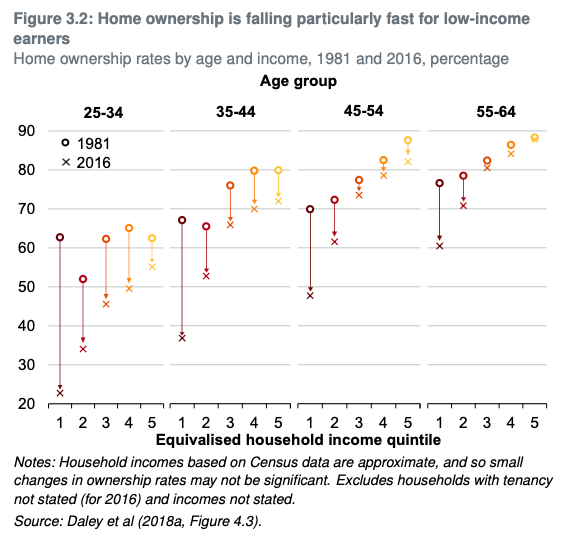

As a result of house price growth radically outstripping income growth, home ownership levels have fallen significantly across the board. One graph illustrates the dramatic change between the 1980s and now. Only the highest income quintiles in older age groups have been relatively immune from the fall; those in the lowest quintile have all suffered double-digit declines, but all groups aged below 45 have seen marked falls in home ownership.

This has a direct impact on inequality. Even before the recent surge in house prices, in the decade prior to 2016, housing helped drive net wealth growth of the two higher quintiles to levels that are multiples of those of lower quintiles. Housing is a slow-motion inequality bomb that is stretching Australia apart along income and age lines.

Apart from abolishing negative gearing and reducing the capital gains tax discount — which the Grattan team believes would only partially reduce demand and would have a small negative effect on house prices — the report sees the biggest problems as a failure to provide housing supply due to regulation and community opposition. Our level of housing stock — 400 dwellings per 1000 people — is far below the levels of other developed countries. In particular, we’ve failed to address the desire for townhouses, semis or apartments in more accessible suburbs rather than for new detached housing on the urban fringe.

But there’s bad numbers either way if there’s a significant boost in housing supply. It wouldn’t do much in the short term: “adding an extra 50,000 dwellings to Australia’s housing stock — an increase of about 25 per cent on current levels of construction nationally, or roughly 0.5 per cent of the national housing stock — would lead to national house prices being only 1 to 2 per cent lower than otherwise”. But the longer-term political implications are significant:

these estimates also imply that a sustained increase in housing supply would have a big impact on house prices. For example, if an extra 50,000 homes were built each year for the next decade, national house prices and rents could be between 10 and 20 per cent lower than they would be otherwise.

Note that that is off where prices would otherwise be, not an actual fall — but even so, no politician is going to want to tell homeowners that their main asset is going to grow noticeably less in value.

Based on that grim maths, the report recommends significantly expanding Commonwealth Rent Assistance, establishing a Social House Future Fund worth $20 billion using Commonwealth borrowings to fund ongoing social housing funding, and funding Brendan Coates’ proposal for a national shared equity scheme to encourage shared equity housing purchases by low-income people — which the report acknowledges will increase demand for housing, but that tightly targeting the scheme toward both low-income earners and lower-priced homes would reduce the risk.

In policy terms it’s a kind of counsel of despair — acknowledging that we’ve created a politically insoluble problem around the power of homeowners versus the rights of particularly lower-income and younger Australians that can only be addressed by expanding government support for renting and purchasing housing stock.

After Labor’s costly embrace of real reform in 2019, no one in the major parties is talking about significant housing policy reform. Meanwhile, the profound inequity we’re baking into Australia’s economy and society worsens.

But “we” voted against doing anything about negative gearing (which gives real estate/property/asset rich investors a huge bidding advantage over actual home buyers in the market), for start, at the last election.

Enough people were egocentric enough and prepared to be scared sh*tless by the Coalition/Murdoch BS scare campaign and vote accordingly – voting against Labor’s negative gearing policy, and against a majority, greater good (including many of their own?), interest.

Good article, Keane. We are moving rapidly into a two-tier society, owners and renters, and it will be as bad as any caste, colour or class based inequality.

Just the ‘two’ tiers? We should be so lucky.

If history be any indication, there will be many more and all, deliberately, pitted against each other to grasp what crumbs they can from the Masters’ tables.

Not necessarily Frank, most of northern Europe lives this way. The huge difference is that they have long leases and regulated rentals. There were huge protests in Germany recently when councils tried to diminish some rental rules. Australia has minimal regulation and renters suffer severely because of it.

One of the main reasons Euroland has been so socially quiescent since WWII is security of tenure for renters.

Include social housing, subsidised state/private co-ops, rent control and certainty that there will be somewhere dry & warm to live goes a long way to ensuring contentment with low wages and other inequalities & abuses which makes life so horrendous in the USA.

It is rare for young people, esp in the northern EU, to even consider buying a house – usually the first step to ensuring social stability is having something of worth to lose.

In the UK council tenants used to have that but MrsT sold them off for peanuts to long term tenants – within 5yrs almost 70% had onsold to the usual rapacious landlord class.

The numbers supporting constantly increasing house prices are relatively small but very loud. They include the real estate industry, big developers (often land bankers and speculators), the banks, commercial media, and around 5% of the population who own more than one property. Can also probably include around another 3% who plan to do buy an investment property. Finally include people who bought recently with high mortgages, who fear they could go under water if prices drop. There is also a small group who make money purely through speculation and are completely reliant on prices increasing always and constantly.

Anything that improves housing availability will negatively affect housing prices and create loud and in many cases organised resistance from sections of this group. The 55-60 percent of those owning or buying their single property, combined with those shut out, are the hope for a policy turnaround. However this also means single owners seeing, as many do, that by and large rising house prices are irrelevant to them, inasmuch as selling would also require buying. A net gain requires buying a smaller property, preferably in a different market. Alas this option still has appeal for some contemplating retirement. But a majority support should be there for policy change. However, this group is not organised. It remains that it is a very brave politician who takes on the property lobby. The last Federal election only reinforced that and so does the current fate of the social housing levy in Victoria.

I am not convinced by the assumptions about what voters and home owners will accept to decrease inequity. Neither am I convinced that Labor’s negative gearing and capital gains tax policies were particularly influential in it loss in 2019.

On the first point, all reasonable home owners will accept that their house is insanely over-priced and many would be prepared to see that insanity abate and non-home owners obtain the advantage of the abatement.

On the 2nd point, some vision and courage in explaining the deliberate inequity of people with either 0 or 1 home subsidising the economic adventure of all those with 2 or more. Further, as I recall, the rationale for the concessions was that it would increase housing stock, thereby reducing buy and rent prices by reducing demand. It does not take a policy genius to understand the outcome has been the complete opposite.

It is also the case that inequity cannot effectively be reversed by attacking just one of its factors or consequences at a time. A much more coherent and comprehensive approach is required: equity in education, equitable wealth transfer through wealth taxes, more social housing, legislation to secure long to rental opportunities, equity in health services deliver etc etc.

Yes but there is a lot more to people just accepting that their main asset, their home, is insanely overpriced and want that situation abated and potential home owners advantaged. This can only mean , consciously or subconsciously, that this will involve policies that will drastically reduce the value of their main asset and, if they get sick or injured or lose their job, and asset prices decrease in value, they will owe more than what their home is worth. This situation faced people in the 1990s and schemes like Homefund didn’t help. People are scared to death of a collapse in asset prices and you can bet your bottom dollar that if asset prices like stocks, shares and property decreases substantially – so will economic growth and employment. More bad news in turn. Can we win?

We’re in a housing crisis

Right now, property prices are surging to record highs. A generation of renters have been locked out of home ownership, unable to save enough for a deposit, while continuing to face rising rents.

Decades of governments have rigged the private housing market with tax breaks that favour big developers and rich property speculators – our current housing system is worsening inequality.

Homelessness is on the rise, and today people face decade-long waits for access to affordable housing.

The housing market is broken. It’s time to think differently.

https://greens.org.au/housing