UPDATE: Since this story was published a spokesperson from the Future Fund has told Crikey that the fund is seeking to “wind down” its exposure to Russian markets.

“The Future Fund has implemented all sanctions imposed by Australia, the United States and the European Union to date.”

“We have devoted significant resources to compliance and will continue to do so as additional sanctions are announced.”

NSW Treasurer Matt Kean this morning announced the state’s investment fund is set to dump $75 million worth of assets in response to Russian President Vladimir Putin’s invasion of Ukraine. It’s another case of a state government leading from the front, and one that puts more pressure on Australia’s sovereign wealth fund, the Future Fund, to take a similar position.

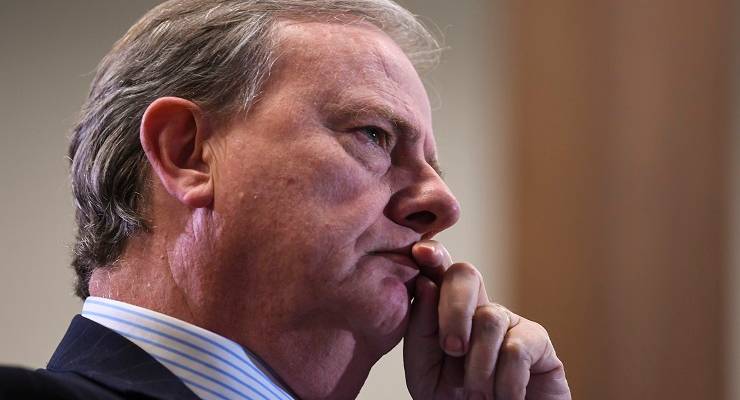

The Future Fund, which is chaired by Howard-era treasurer Peter Costello, controls around $200 billion in investments made on behalf of the Australian government. And because it is only required to disclose its top 100 listed equity holdings, we don’t know how much money it has invested in Russia.

The fund, and Treasurer Josh Frydenberg’s office, didn’t respond to questions about its Russian investment by deadline.

Civil society groups are calling for greater transparency, and for the fund to immediately divest any Russian assets. Director of climate and environment at the Australasian Centre for Corporate Responsibility Dan Gocher told Crikey the future fund had to divest given the nature of the conflict and the response from Australia and Western allies.

“I don’t think they’ve got any choice but to divest,” he said.

“As we’ve seen from the announcement from the government this morning, it’s about doing everything possible to isolate the regime.”

The Morrison government announced an escalation of its economic sanctions against Russia today, expanding the list of individuals targeted, and throwing its weight behind international financial pressure placed on Putin.

Gocher said it would be relatively easy for the Future Fund to isolate any Russian holdings, but might struggle to find a buyer as global markets distanced themselves from Russia.

There’s also international precedent for such a move — over the weekend, Norway announced it would drop US$2.8 billion worth of Russian holdings from its sovereign wealth fund.

Rawan Arraf, executive director at the Australian Centre for International Justice, said the Future Fund had to take action in response to the invasion.

“I’d be surprised if they’re not trawling through their investment list at the moment, and I’d hope the Australian government had put out an advisory note to the fund,” she said.

The Russia crisis, and potential divestment, could provide an opportunity for the fund to address what critics say are problems around transparency, and a failure to adequately meet its own environmental, social and governance (ESG) requirements.

Last year documents released under freedom of information (FOI) laws revealed the Future Fund had invested $157 million in companies which had done business with Myanmar’s junta, including a Chinese state-owned weapons manufacturer. The fund divested from that company, the Aviation Industry Corporation of China, but only because of an American sanction which affected its US-based fund manager. More recently, the fund was revealed to have invested $90 million in arms manufacturer Raytheon.

Meanwhile, the Morrison government introduced laws last year which would exempt many of the fund’s activities from FOI laws. They are yet to pass Parliament.

Arraf said the fund was already less transparent than other Western sovereign wealth funds, even without the laws being passed.

“As a sovereign wealth fund from a democratic country, they only disclose their top 100 investments, whereas with countries like New Zealand and Norway, you’re able to go on their website and access entire holdings,” she said.

“The ESG policy is really weak, and, even so, it’s clear they don’t actually follow it.”

Yet another example of secrecy creep in our government.

Kishor,

We all know it was Scomo BSing about sanctions to look good for the Big Boys and attract a few of the war mongering votes (Those that want war but expect others to fight on their behalf.) in the Federal election.

Love your work but the KEY issue is HOW MUCH WOULD REAL SANCTIONS COST EACH AUSTRALIAN IN THE HIP POCKET.

Big numbers and Government are just numbers. But say to an Aussie Thank you for you $5 000? contribution this year for the war in Ukraine or the 50? cents per litre price increase in petrol and they might wake up

Absolutely. All of the Western Countries are beating the drums.

We’ll fix those Russians – Sanctions, sanctions, sanctions.

The trouble is that a lot of it will backfire, causing economic damage in our own Countries.

Trumpistas yayed his ‘sanctions’ on Chinese imports, which Walmart their teat of Life, added to their prices.

Still they yayed, thinking (sic!) it was somehow hurting Chainna.

Australian (American?) ‘values’, support for democracy and the nation requires an assessment of ‘how much is it going to cost financially’? Says a lot about why Australians are obsessed with property and have high level of depression?

The Tories in UK are up to their necks in Russian money/property, but also crosses individual MPs, who are also up to their necks in US think tanks supporting fossil fuels, and implicitly Russia (with many US fossil fuels related companies invested in Russia and Ukraine); through London legal, financial and banking firms of ‘enablers’.

However, BP is pulling out of their Russian investment, others will probably follow; watch US as their mass of influential ‘fossils’ squirm, led by Koch Network……

Wind down Costella, Downer,Howard .Bring in ICAC

How can smirky be fund manager and right wing propagandist at Nein.. have a look at the future this twat dished up from his time as treasurer..