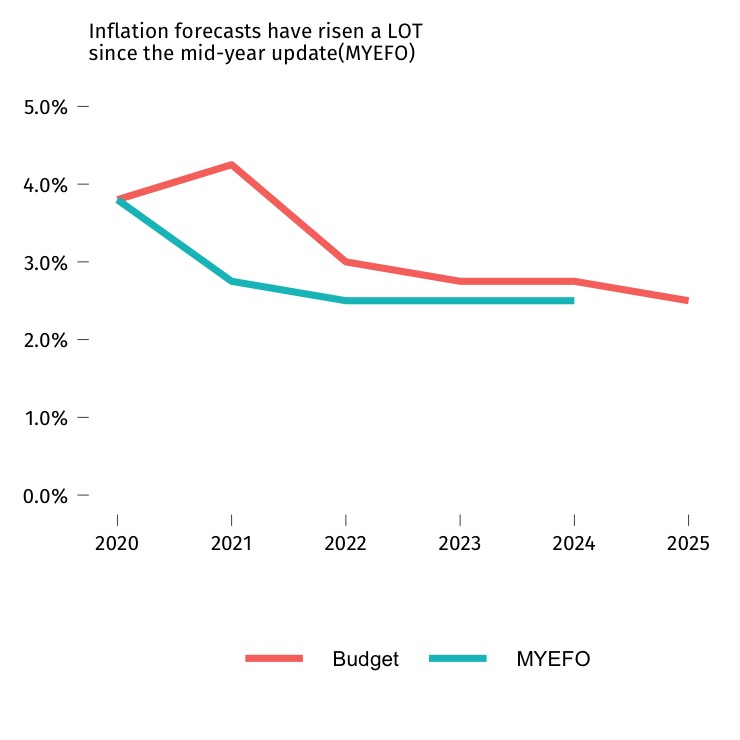

Prices are rising at a monumental 4.25% a year, the budget tells us, and they’re never going back down. It will be years before even the pace of price rises falls back to its old levels of around 2% a year. The next graph shows how much the outlook has worsened — a lot, and all in the short time since the recent mid-year update.

There are three terrifying poisons in the price outlook. Let us call them Pain, More Pain and Lies.

Pain

Inflation means pain for a lot of people. A rate of 4.25% is higher than we have seen in the data so far. The official Consumer Price Index (CPI) is at 3.5% and people are losing their minds. Politicians are focused on cost of living to the exclusion of almost all else.

The purest example of this is the cut in fuel excise by 22 cents, without even a glance in the direction of the fact we are actually trying to wean ourselves off fossil fuels. An inflation rate of 4.25% could drive Australians — and our politics — completely mad.

More pain

The big risk to the outlook is that the inflation we’ve seen so far is just a tasty amuse bouche. In America, consumer price inflation has hit a shocking 7.9%. Why should we expect Australia to get off lighter?

“The outlook remains for Australian inflation to peak well below that in most other advanced economies,” Treasurer Josh Frydenberg announced in his budget papers.

Will it? We are part of the same global markets. The temporary cut in the fuel excise alone guarantees lower inflation now at the price of higher inflation later. The cut of 22 cents per litre will reduce inflation by 0.25% now, but is a poison pill for the future, guaranteeing inflation will be higher when — or if! — the excise cut expires.

The American scenario should terrify us. If inflation rises to 7.9%, it means the buying power of a dollar falls by 7.9%, and everyone with cash saved — indeed anyone making returns of less than 7.9% on their investments — is worse off. That’s a rapid hit to people’s standard of living, and lifts pressure on the Reserve Bank of Australia to hike mortgage rates in a way that will clamp down on household budgets.

Lies

While inflation wreaks direct havoc on the buying power of our currency, it poisons the political environment by smoothing the way for lies. The higher inflation is, the more vital it is to distinguish between numbers adjusted and unadjusted by inflation. The government will be able to slash the buying power of funding for institutions like the ABC or the health system, while arguing — accurately — that they are giving those institutions record funding.

My advice to any political watcher is to view claims of record spending with extreme scepticism in an era of high inflation. Familiarise yourself with the nomenclature. In budget speak, “real” means “inflation-adjusted” while “nominal” means a figure is not adjusted for inflation.

For example, the following claim in the budget papers:

“The unemployment rate is now at a multi-decade low, with the tightening labour market and wage increases expected to drive higher personal income tax receipts, and flow through to higher nominal consumption.” Emphasis is mine.

Higher nominal consumption just means we are spending more money, not that we are getting more for our money. The higher inflation rises, the more we need to beware of any statement that doesn’t specify whether it is talking in real or nominal terms.

It may be designed to deceive.

If the barely contained inflation balloon is about to burst why aren’t wage increases picking up pace? Are we experiencing a bout of stagflation? And what, historically, are the consequences of stagflation?

Nothing good!

“Employment” includes all the people working at least one hour a week. Any statistics based on that fact are just toilet paper.