A lesser-known agenda item for the incoming Labor government is the vexed issue of debanking — whereby the banks use sometimes dubious justification to deny financial facilities to sole traders and small businesses.

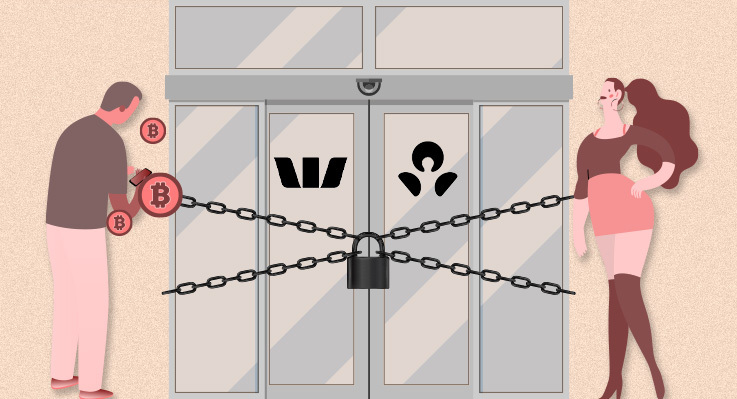

This ongoing problem has been highlighted by the recent case of Canberra crypto-trader Allan Flynn, who had his bank accounts shut down by Westpac and ANZ.

Flynn filed complaints against the two banks with the ACT Human Rights Commission, claiming they unlawfully discriminated against him by refusing to provide banking services on the grounds of his occupation.

ANZ reached a settlement, acknowledging that its action “could have amounted to unlawful discrimination”, and gave him the opportunity to reapply for an account.

However, the case against Westpac proceeded to the ACT Civil and Administrative Tribunal, where Westpac argued its decision to block Flynn’s personal and business accounts in perpetuity was because his crypto business “fell outside Westpac’s risk appetite” and its obligations under the money-laundering and terrorism-funding regulations.

It should be pointed out that AUSTRAC, the relevant government agency, recently stated: “The effect of debanking of legitimate and lawful financial services businesses can increase the risks of money laundering and terrorism financing and negatively impacts Australia’s economy. For this reason, AUSTRAC continues to discourage the indiscriminate and widespread closure of accounts across entire financial services sectors.”

AUSTRAC added that closing of accounts in entire industry sectors leads to debanked businesses being less open about the nature of their business relationships with banks, which in turn increases the difficulty of distinguishing lawful activity from unlawful activity, with consequential effects on law enforcement.

Moreover, the banking industry’s own review of its code of practice late last year recommended that banks should not have a “blanket” denial of banking services on the basis they are concerned the anti-money laundering provisions may come into play.

Independent reviewer Mike Callaghan rebuked the banks for denial of services seemingly based on the customer’s occupation. He said this was “without understanding the nature of the industry in which the customer operates”.

In a lengthy judgment published on March 17, the ACT tribunal refused to dismiss Flynn’s discrimination application as requested by the bank, but said the bank’s defence based on a federal money-laundering and terrorism-financing statute would need to be considered by the Supreme Court.

Two days later, Westpac applied to the Supreme Court to quash the tribunal decision, seeking costs against Flynn.

It would have been a precedent-setting case to address the legal basis of debanking, with enormous business and political implications. But in the face of potentially crippling costs, Flynn is not expected to proceed.

Of course, the issue of debanking spreads far beyond crypto-trading. The Australian Small Business and Family Enterprise Ombudsman has said the greatest volume of denied service complaints received by the agency were in relation to denial or withdrawal of service by financial institutions against a range of small businesses, including “adult service (brothels, individual sex workers and sex shops), tattoo parlours, cryptocurrency traders, precious metal traders and newsagencies providing Western Union remittance services”.

In fact, just last month high-profile Sydney escort Samantha X reported her long-standing account with ING had been shut down with no explanation.

“They told me they had closed my account,” she said, “and when I asked what they meant, they said ‘we can’t tell you why sorry, it is a business decision’.”

Given that Allan Flynn could not afford to pursue his case against Westpac in the Supreme Court, it may now be up to politicians and bureaucrats to take up the fight against debanking by the big financial institutions.

In December, former treasurer John Frydenberg released the government response report “Transforming Australia’s Payments System“, which said:

On the complex issue of ‘debanking’ … the government will task the Council of Financial Regulators, assisted by other relevant agencies, to provide advice on policy options to the government by mid-2022.

In the wake of the election, the Albanese government needs to demonstrate its support for small businesses and force the banks to end unwarranted discriminatory policies and practices.

Tony Jaques is CEO of Melbourne-based consultancy Issue Outcomes and his latest book is Crisis Counsel: Navigating Legal and Communication Conflict.

It is certainly the case that “debanking” is becoming more popular here and abroad – often for EGS reasons (take the debanking of firearm manufacturers in the US as example).

I think unlike other consumer boycotts, debanking should be more firmly protected against. Banks hold a special privileged position as financial intermediaries, and unless the industry in question is actually illegal (a call that should be made by our elected representitives and parliament), then there should be a certain “right to bank”.

Yes, it is much harder than it used to be to manage without a bank account so up to a point access to bank services is a basic necessity. Not quite at the level of food, clothes and shelter, but it is still something that should be available to anyone unless there is a very clear good reason for refusal. And that reason should be given. It is outrageous to hide behind cowardly obfuscation such as ‘we can’t tell you why sorry, it is a business decision’.

Still, it’s not a consumer boycott. It’s the opposite – a boycott of the consumer.

The irony here is both exquisite and enraging. Do the banks not see how hilariously hypocritical is their moralism about money laundering by some of their minnow customers. Were not both Westpac and the ANZ successfully prosecuted for criminal negligence in controlling money laundering? Did none of them hear the mountains of damning evidence heard by the Hayne Royal Commission? Is there no perversion to which the banks are averse?

Anyone recall how, in the noughties under pressure from the Septics, all the credit card companies suspended payments to Wikileaks?

Or UK/USA withholding from Iran hundreds of millions of dollars for several decades?

When money becomes electrons in the ether, detached from real goods – never mind value, not being a gold bug or nuttin’ – we become serfs, at the mercy of those with their fingers on the buttons (apart from elsewhere).

Fiat currency is suspect in the first instance and risky always.

Venice didn’t become and remain a banking powerhouse because of its vast natural resources or military might.

It was a result of the dependable store of value due entirely to family ties between the Diaspora in Europe & the Levant – not subject to the will of kings & despots.