With Energy and Climate Minister Chris Bowen meeting state and territory counterparts and energy regulators today, the ghost of Angus Taylor hangs over the gathering beyond his role in creating an energy crisis by trying to shackle Australia to coal.

Bowen and the Energy Security Board will press ahead with Taylor’s “capacity mechanism” that would see retailers — and thus customers — pay providers for dispatchable power capacity, even if it’s not used.

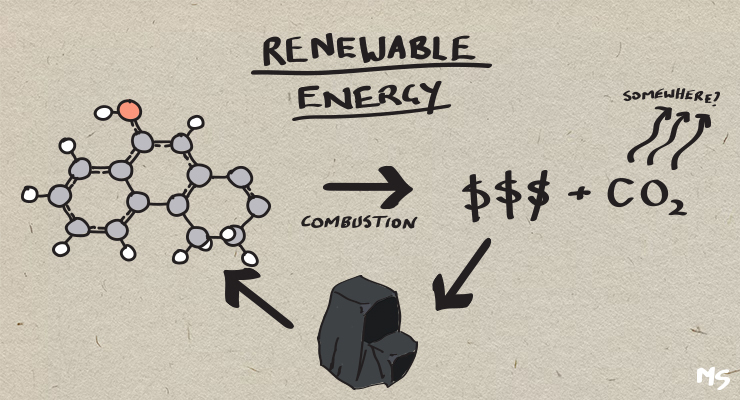

Under Taylor, it was a mechanism to prop up coal-fired power beyond its economic life, as renewable energy dramatically undercut the deadly fossil fuel. Taylor wanted households to pay fossil fuel companies to keep burning coal even when it wasn’t needed, aka CoalKeeper.

The Energy Security Board insists it’s the only way to ensure that we don’t face energy crises every time unreliable and increasingly intermittent coal-fired power suffers another fire or breakdown, like the ones that have pushed demand for already expensive gas to record levels this winter.

CoalKeeper was resisted by the states, and Bowen needs to rule out the “capacity mechanism” supporting fossil fuels — either gas or coal — in the future. It must be confined to storage and pumped hydro and not used as a backdoor way to prop up a decrepit fleet of coal-fired power stations that pump up massive levels of carbon emissions and kill hundreds of people a year through their pollution, or embed expensive gas as a “transition fuel”.

And how will it be paid for? Is the message from governments that consumers must face still higher bills on top of what they were facing?

Consumer interests risk being omitted from the energy debate as key players take up their business-as-usual positions — big energy users and energy-intensive manufacturers call for intervention to redirect exported gas domestically, the gas industry insists anything that stops them making massive profits from gas exports will destroy them, and suggest everything would be fine if they could just frack wherever they like.

This is not business as usual — gas exporters face an historical boom as Russia’s assault on Ukraine drives up prices and Europe looks to replace Russian gas with gas sourced elsewhere. The only ones benefiting from soaring gas prices are multinationals like Exxon and Chevron and local fossil fuel giants Santos, Woodside and Origin, none of whom pay significant tax on their massive revenues. Meanwhile, households and small businesses face surging power costs, which in turn feed into higher interest rates.

The government faces a simple matter of equity here: while large corporations that pay minimal tax make tens of billions in windfall profits driven by factors beyond their control, the rest of us suffer the consequences, with flow-on implications for economic growth and employment.

A windfall profits tax — which Treasurer Jim Chalmers wrongly keeps ruling out — could be used to fund cost-of-living measures such as a power bill offset for low- and medium-income households and small businesses. It would be better than imposing a domestic gas reservation on existing supplies, which might endanger long-term export contracts, and would partly remedy the major fiscal problem that one of our most valuable resources is being sold without any benefit to Australians.

The fossil fuel multinationals are already complaining about any mention of a windfall profits tax in Australia after the UK Conservative government imposed one. Chevron evidently sees a new government as an opportunity to reopen the issue of the decommissioning levy that the previous government imposed on the industry after fossil fuel companies tried to dump the cost of decommissioning an oil platform in the Timor Sea on taxpayers. Chevron lobbied hard against the levy, trying to convince the Morrison government to abandon the idea and making its own unsolicited proposals for how the decommissioning cost should be paid for, but in a rare rebuff for the industry, failed to sway the government.

The predictable argument against a windfall profits tax or any other kind of intervention is that such regulatory uncertainty would deter investment. That claim was fatally undermined in May when the British head of BP — who had described the company as a “cash machine” given its massive profits — said there was no investment BP wouldn’t undertake even if there was a windfall profits tax there.

A windfall profits tax was good enough for the UK Tories. It was good enough for Scott Morrison to impose on Australian banks when they were making huge profits while gouging and ripping off Australian consumers. It’s certainly good enough at a time when foreign shareholders are enjoying massive returns while households and small businesses here struggle.

There has never been a better time for the Government to revisit Super profits and rent resources taxation. 12 years of income have been lost to Australia and much of our political instability was created by the cabal of conservative media, political parties and the fossil fuel multinationals forged in 2010 to fight taxation and climate change.

They will squel about Australia losing jobs and future investment but we know that argument is a furphy now and who gives a damn what Rupert and the Nationals want anymore.

Make them pay, they will stay and we will benefit greatly as a Country.

If not now, when?

Yes exactly. A windfall profits tax would inhibit investment in further gas extraction… So that’s another good thing. Overall as energy prices go up, windfall tax is used to offset the burden on the vulnerable and the higher gas price makes renewables comparatively cheaper and a better place for investment. With enough of this renewable investment energy prices will eventually fall along with carbon emissions. All good.

More complicated politically of course but as you say Jen, if not now, with an election just won and around a quarter of the non-government backbench likely to support it, then when?

Such a tax should apply to all mineral Australian resources, not just fossil fuels.

Such a concept has been floated before, fifteen years ago. It was skewered by a combination of the rich and powerful mineral lobbies working in concert with the LNP and the Murdoch press.

If any attempt is made to reintroduce a similar tax, it will face immediate, coordinated opposition from exactly the same lobbying group: a group of almost limitless wealth and political power. The end result will then be exactly the same as last time.

The only way the attempt will be successful is if a parallel strategy is put in place to skewer the opposing lobby before it can skewer back.

So while I fully agree with your article, Mr. Keane, what’s the strategy to deal with the second issue?

It’s true the lobbying against the Henry Report’s mineral resources super profits tax was extensive, expensive and relentless, but please don’t absolve the government of the time which was too gutless to stand up to it. That’s what we pay these clowns for: to make and implement decisions in the public interest; not run away when it all gets too hard and they fear for their political future.

So what? After a decade of libs getting rid of our automotive industry losing hundreds of thousands of jobs, giving billions to fossil fuel industry supposedly to prop up a few thousand jobs and giving billions in corporate tax cuts (none of which Labor made much of a fuss about by the way),

after all this it should be dead simple to make an argument for both increasing corp taxes and introducing a super profits tax. Labor is dealing with a public which is sick to death of govt largess toward its corp mates, corruption and hungry for positive changes. It’s time they used ridicule as a bulwark against the faux gnashing of teeth and crocodile tears from the far right especially Ltd News who’s journos for some reason seem to buy into its philosophy of corporate domination of govt over the people.

Hi Graeski. “Such a tax should apply to all mineral Australian resources, not just fossil fuels.” all mineral resources are subject to royalties and other such State imposed levies (for want of a better word).

Are you seeking taxation (a broad word) at a second level, by the Federal Govt?

I agree. I’m hoping that there’s fierce discussion in the back play between government and the gas companies along the lines of “OK we won’t hit you with a windfall profits tax but in exchange you’ll actually have to pay a meaningful amount of resources rent tax starting 12 months ago”. That could be a working template for the rest of the resource sector. If not now, when?

A failure to quickly impose a windfall profit tax will constitute a betrayal of the Australian people. Jim Chalmers should get his head out of his neoliberal ar*e and get on with it. What’s the point of these massive capital investments if all Australia gets out of is jobs; ie those jobs not filled by 457 visa holders?

Labor needs to understand that while its timid policy agenda has been endorsed by The Australian electorate, that electorate also said, loudly and clearly by voting in som many like-mined independents its and Greens, that timid agenda is not enough!

Why should enormous fossil fuel companies not pay a profit tax when ordinary

workers pay tax, and then more tax when they do overtime or work another job,

or win in lotto or any other financial gain just trying to survive. Most can’t afford

a holiday or a car cwhen these CEOs and shareholders probably have holiday homes

and boats as well as cars. Pay your dues, this isn’t Panam.

A lot of them can’t even afford rent.