The Reserve Bank will lift interest rates by another 0.5% after today’s July board meeting, with the cash rate target rising to 1.35%. The rise will crunch mortgage holders with the second 0.5% rate rise in a row, on top of a 0.25% rise in May.

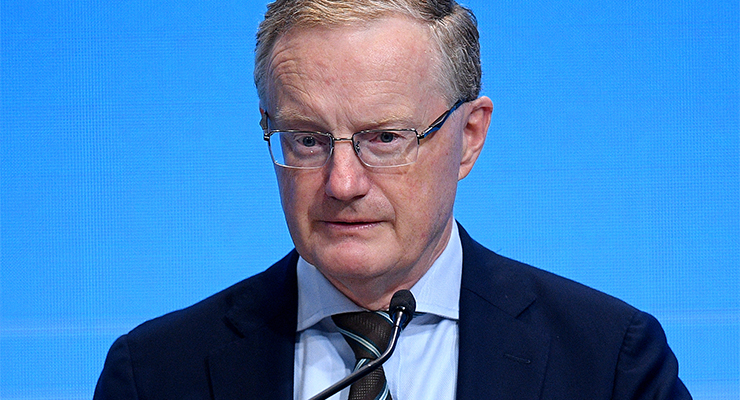

The RBA remains convinced that the economy is strong and households can handle plenty of financial pain. “Households have built up large financial buffers and are benefiting from stronger income growth,” RBA governor Philip Lowe said in his post-meeting statement, in which he promised more pain was on the way.

He also continues to insist that higher wages growth is just around the corner: “the Bank’s business liaison program and business surveys continue to point to a lift in wages growth from the low rates of recent years as firms compete for staff in the tight labour market”. The wage price index was stuck at 2.4% in the March quarter, the same low rate as before the pandemic.

Lowe is anxious for Australians to understand that these unprecedented rate hikes are simply a return to normal. “Today’s increase in interest rates is a further step in the withdrawal of the extraordinary monetary support that was put in place to help ensure the Australian economy against the worst possible effects of the pandemic,” he noted, stating that this support is no longer needed.

And there’s more pain to come for households. “The board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead,” Lowe said.

And what data did they use this time? The vibe?

I have given crikey the the reason but my post is still awating approval after 54 minutes

maybe its because my answer was the truth and not one particular party is to blame they all are

54 minutes? Wait a few days…

With the rising of prices, there’s already pressure to spend less. This is rubbing salt in the wound.

Households can just ‘take one for the team’ as per usual

The misunderstanding is believing that pretty much anything the RBA or the national government does makes a lot of difference in a hyper connected world. One of the biggest drivers of current inflation in fuel prices, driven by a war on the other side of the planet, and materials shortfalls, driven by supply chain issues almost everywhere, especially China. Nothing the RBA does will make a difference to either of those issues

Some talking head blamed rises in the cost of food on the Ukraine war.

Why is this agriculture exporting (70-90% of produce depending on grain or flesh) importing food?

Just. Stop. It.

What a jerk. He tells us that higher interest rates are a return to normal which is fair. 0.1% as an official rate is too low. But he still keeps repeating like a broken record that higher wage rises are just around the corner. he’s been saying that for years. Why can’t he browbeat our businesses and government into facilitating a fairer industrial relations system to guarantee such wage rises? Why doesn’t he just call the previous coalition government out? The FWC are obviously not doing their job.